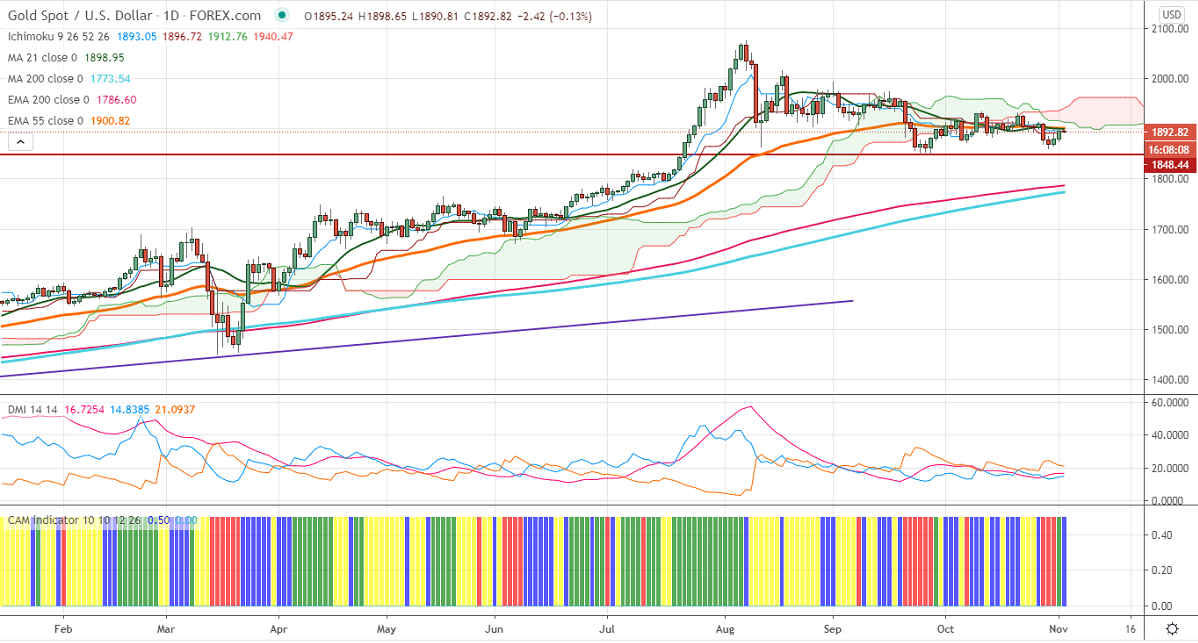

Ichimoku analysis (Daily chart)

Tenken-Sen- $1895

Kijun-Sen- $1891

Gold is struggling to break above $1900 as markets eyes the United States election for further direction. Markets will not get a clear answer on election results on Wednesday. The demand for safe-haven assets like the dollar and yen might drag the gold prices down.

Democrats get a majority in the house and the senate will be positive for gold as Biden promised to provide more stimulus in the first hundred days. It will increase inflation and support precious metal.

If Trump gets re-elected US dollar will gain strength and this will cap the yellow metal movement.

Technical:

In the daily chart, the yellow metal is facing strong support at $1860. Any break below will take the pair till $1848/$1830. On the higher side, near term resistance is around $1900 and any indicative break above that level will take the pair till $1910/$1921/$1933/$1950.

It is good to buy on dips around $1860-62 with SL around $1850 for the TP of $1920/$1933.