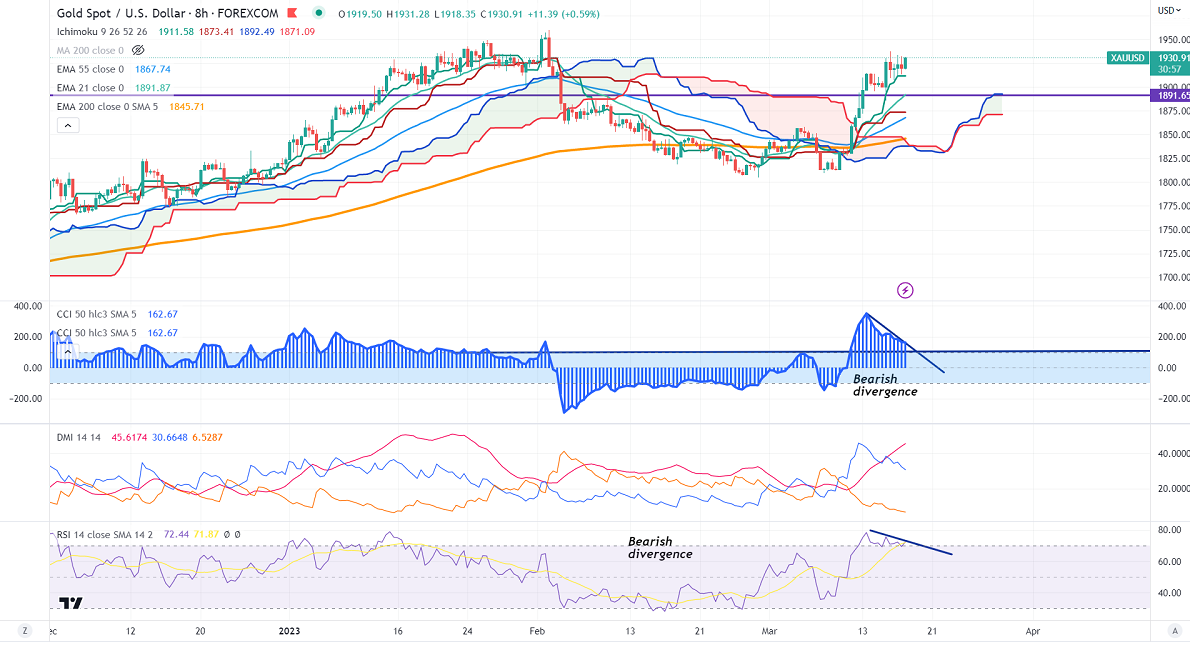

Ichimoku Analysis (8-Hour chart)

Tenken-Sen- $1911.58

Kijun-Sen- $1873.41

Gold prices showed a minor decline after ECB monetary policy. The European Central bank has hiked rates by 50 basis points and said that it is ready to support banks if needed. Gold hit a high of $1933.54 and is currently trading around $1928.61.

The number of people who have claimed unemployment benefits declined BY 20000 to 192K for the week ending Mar 11, compared to a forecast of 205K. US Philly fed manufacturing index improved to -23.2 in Mar, slightly above the estimate of -14.5.

US Banking crisis-

According to JP Morgan, US Fed's emergency loan program may inject $2 trillion in funds into the US banking system to ease the liquidity crisis. This will increase the demand for riskier assets like stocks, Crypto. For the short term, we can go short in Gold. The overall trend is still bullish.

Technical analysis-

CCI (50) and RSI (Bearish divergence (8-hour chart))

Technically the yellow metal has formed a bearish divergence in the 8-hour chart, a minor decline to $1885/$1870/$1858 is possible.

Significant bullish continuation only if it breaks $1938. Any breach above targets $1959/$1970.

US dollar index-Bearish. Minor support around 103.50/102.50. The near-term resistance is 104.70/105.10.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Mar increased to 83.4% from 54.60% a day ago.

The US 10-year yield pared some of its loss and surged more than 6.% from a minor bottom of 3.36%. Any break below 3.32% confirms further bearishness. The US 10 and 2-year spread narrowed to 61% from -107%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

It is good to sell on rallies around $1932-33 with SL around $1945 for TP of $1880/$1858.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?