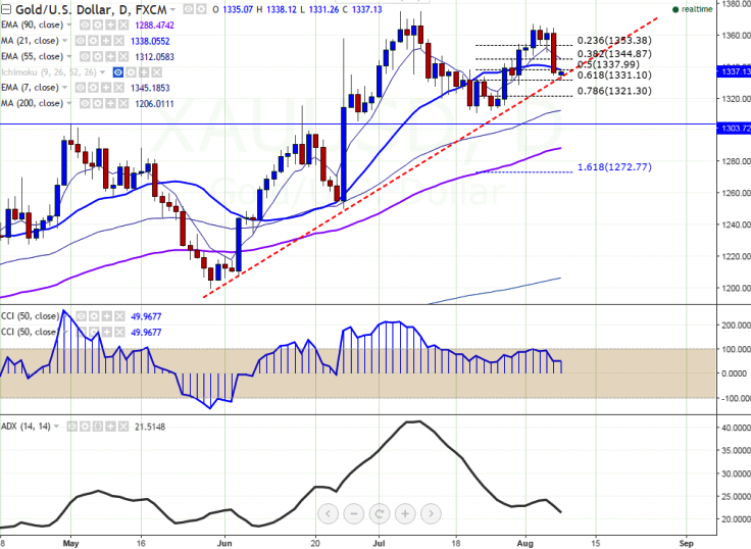

- Major support - $1330(61.8% retracement of $1310.71 and $1367.15).

- Major resistance- $1347 (200 HMA).

- Gold declined sharply by 1.9% on Friday after better than expected US Nonfarm payroll data.

- U.S economy has added 255k jobs in July vs. expected 180K and headline unemployment rate steady at 4.9%.

- The yellow metal has taken support near 61.8% retracement and slightly jumped from that level.The Intraday trend is slightly bullish as long as support $1331 holds.

- On the higher side, minor resistance is around $1338 (21 day MA) and any break above targets $1344/$1347.Any break above $1347 will take the commodity to next level till $1360/$1365.

- Technically any break below $1331 will drag the gold down till $1325/$1315/$1310.

- Short term weakness only below $1300.

It is good to buy on dips around $1336 with SL around $1329 for the TP of $1345/$1348.