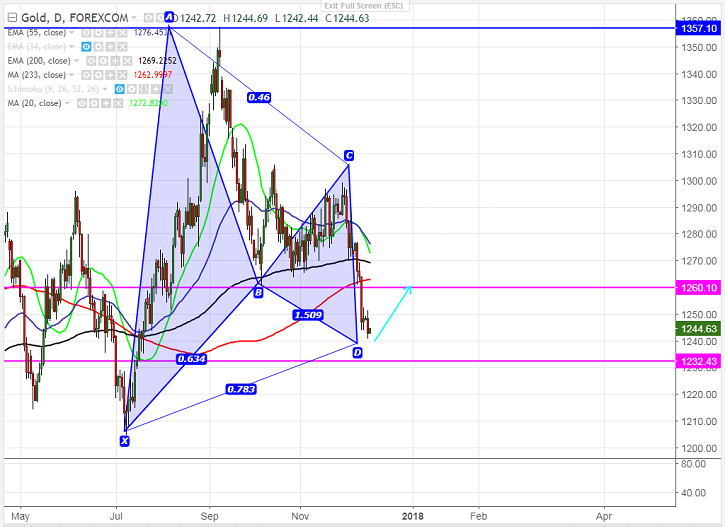

- Harmonic Chart pattern – Bullish Gartley pattern.

- Potential Reversal Zone (PRZ) - $1205.

- Gold is trading weak for the past eleven trading session and declined almost $57 from the high. The yellow metal dipped till $1243.60 due to strong US dollar and rising US yield. It is currently trading around $1244.55.

- The yellow metal has formed potential Bullish Gartley pattern in the daily chart and major weakness can be seen below $1205.

- On the higher side, near term resistance is around $1254 (23.6% retracement of $1299 and $1240.26) and any break above will take the yellow metal to next level till $1260/$1269 (200- day EMA).

- The near term support is at $1239 and any violation below will drag the metal to next level till $1232 (161.8% retracement of $1305 and $1260.45)/$1223 (88.6% retracement of $1204.70 and $1357). Overall bullish invalidation only below $1200.

It is good to buy on dips around $1239-$1241 with SL around $1232 for the TP of $1254/$1260.