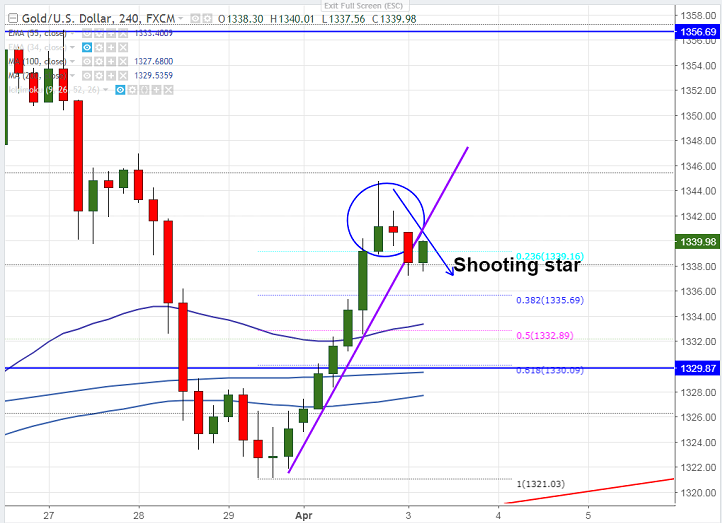

- Candle stick pattern- Shooting star.

- Gold has shown a good recovery almost more than $20 from yesterday’s low of $1324.75 on fresh trade worries. The major reason for good jump in yellow metal was due to trade war between US and China. The trade war worries increased demand for safe haven assets like gold, yen etc. The yellow metal hits high of $1344.75 and is currently trading around $1339.80.

- US dollar index has shown a minor decline after hitting high of 90.15 yesterday. The index hits low of 89.97 and is trading around 89.98.

- The yellow metal is facing major near term resistance at $1347 and any minor bullishness only above that level. Any break above $1347 will take the gold till $1355/$1361 Overall bullish continuation only above $1362.

- On the lower side, near term support is around $1335.69 (38.2% fib) and any break below will drag the yellow metal down till $1330/$1324/$1320.

It is good to sell on rallies around $1340-41 with SL around $1346 for the TP of $1330/$1325.