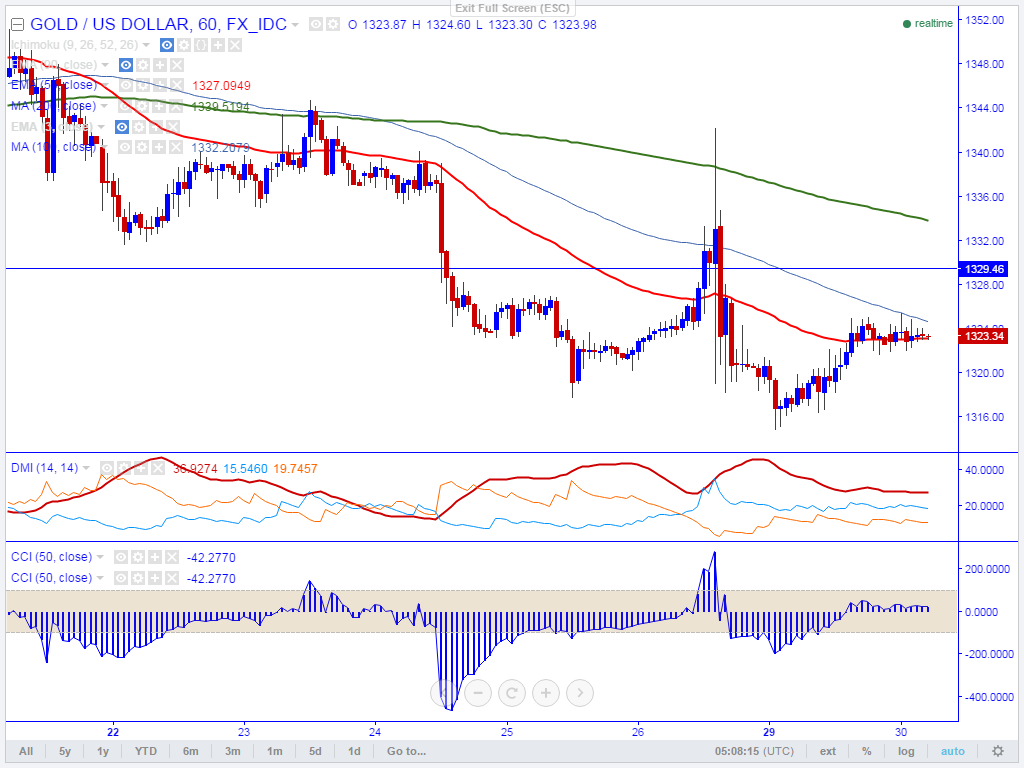

- Major support- $1310.

- Major intraday resistance- $1325 (100- HMA).

- The yellow metal recovered slightly after a making a low of $1314.87 after hawkish Fed chairman statement on the rate hike. It is currently trading around $1323.39.

- On the higher side, for the intraday gold should break above $1325 (100-HMA) for jump till $1333 (200 HMA)/$1340 (61.8% retracement of $1356.09 and $1314.87).The commodity should close above $1340 (21 – day MA) for the further jump.

- Technically the support is around $1310 and breaks below targets 1300/$1293 (100 day MA).

- Overall bearish invalidation only above $1375.

It is good to sell on rallies around $1325-$1328 with SL around $1340 for the TP of $1311/$1300