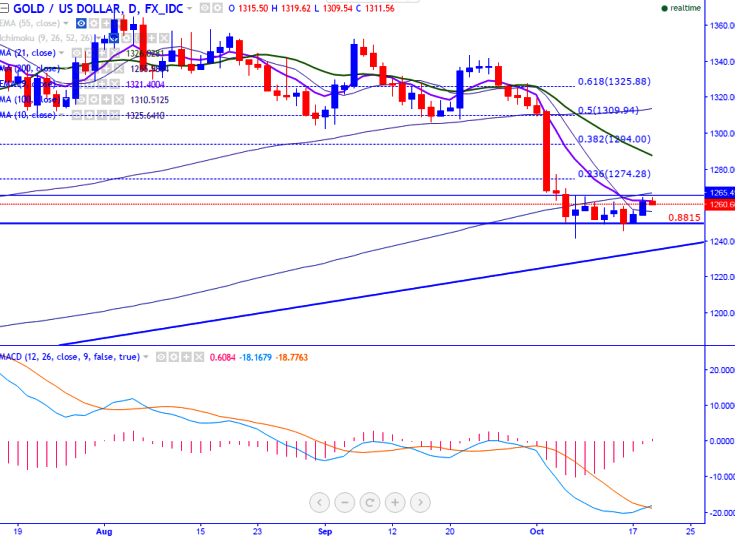

- Major resistance- $1265 (Oct 7th high).

- Major intraday Support - $1250

- Gold jumped till $1264.70 and started to decline slightly from that level. It is currently trading around $1260.58.

- Gold recovered slightly from the low of $1250 on account weak dollar .US dollar index declined slightly after jumping till 98.17 level. It is currently trading around 97.90.

- On the higher side, major resistance is around $1265 (Oct 7th 2016 high) and any break above confirms minor trend reversal. Any violation above targets $1274 (23.6% retracement of $1375.15 and $1241)/$1277/$1295 (21- day MA).

- The support is at $1250 and any violation below will drag the gold till $1226 (161.8% retracement of $1241 and 1264.93)/$1210.

It is good to sell on rallies around $1265-$1267 with SL around $1275 for the TP of $1250/$1241