- shown selling after slightly better than expected US ADP employment data. It is currently trading around $1275 0.09% higher.

- US private sector adds 135K jobs in Sep compared to forecast of 131K but reading was smallest since Oct 2016. Market focus on ECB minutes which is to happen today for further movement.

- ECB has kept its interest rates unchanged in Sep monetary policy meeting and but not mentioned any tweaks to forward guidance. In the current minutes meeting investors will look for clues for QE tapering. Mr. Draghi mentioned that preliminary discussions regarding QE after Dec happened with policy makers and decisions would be made late next month.

- US Dollar index has shown a minor recovery after hitting low of 93.25 yesterday. It is currently trading around 93.51. The pair is facing major support near 23.6% (93) and any break below confirms minor weakness. The near term resistance is at 94.15 and any break above will take the index to next level till 95.

- U.S 10 year yield has slightly declined to 2.33% after hitting high of 2.36% and is expected to show a minor jump on increasing expectations of rate hike.

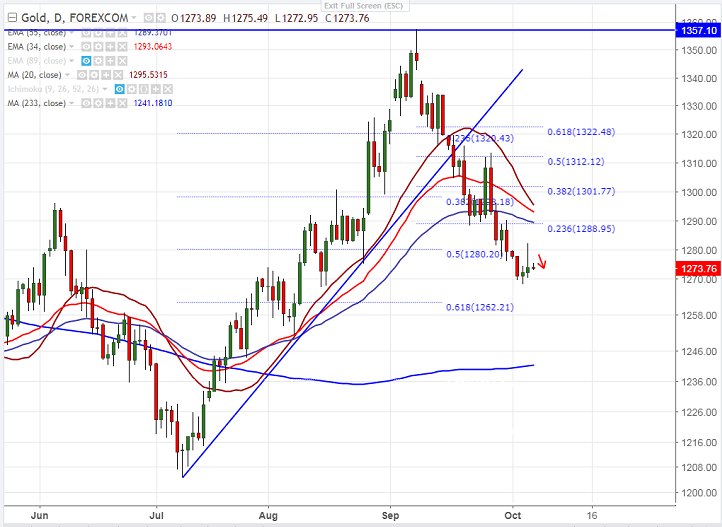

- Technically gold is facing minor resistance around $1278 and any break above will take the yellow metal till $1290 (55- day EMA)/$1302 (38.2% fibo).

- Gold’s near term support is around $1262 (61.8% retracement of $1204 and $1357.90) and break below will drag the commodity down till $1250 (200- day MA).The yellow metal should close below $1250 for major trend reversal.

It is good to sell on rallies around $1275-77 with SL around $1288 for the TP of $1262/$1253.