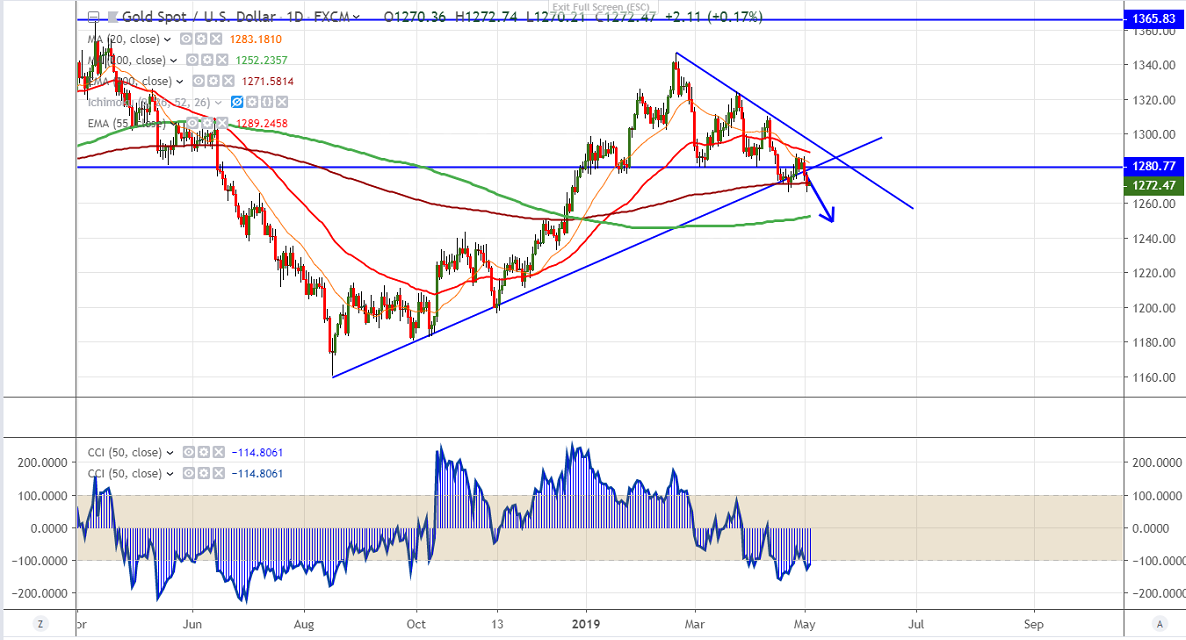

Gold has once again recovered after hitting low of $1266 amid strong US dollar. Markets eye US non farm payroll data for further direction. DXY shown a good recovery of more than 70 pips from low of 97.15. Overall trend is still weak ask long as resistance $1292 holds. US economy is expected to add 185000 jobs in April compared to 196K in Mar and average hourly earnings forecast 0.3% vs 0.1% previous month. Any upbeat hourly earnings will pull EURUSD further down.It is currently trading around $1272.

On the lower side, near term support is around $1266 and any violation below will take the yellow metal to next level till $1260/$1251.

The near term resistance is around $1278 and any break above confirms slight bullishness and a jump till $1282. Any break above $1282 confirms major intraday bullishness.

It is good to sell on rallies around $1275-76 with SL around $1282 for the TP of $1266/$1260.