- Gold jumped sharply almost $16 dollar on Friday on political uncertainty in Middle East. US, British and French air strikes launched almost 105 missiles overnight at the heart of Syria’s chemical weapons program. Donald Trump said in twitter “Mission accomplished”. The escalated geo political tensions has increased demand of safe haven assets such as yen, gold etc. It is currently trading around $1343.44.

- US dollar index dipped almost 30 pips from yesterday low of 89.96 and is currently trading around 89.75.

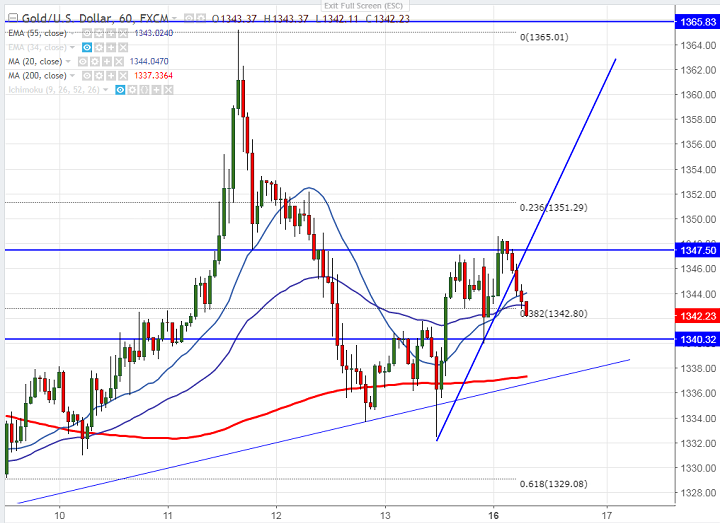

- The yellow metals near term resistance at $1350 and any break above will take the yellow metal till $1355/$1365. The major bullishness only above $1365. Any break above $1365 will take the gold till $1374/$1380.

- On the lower side, near term support is around $1333 (20- day MA) and any break below will drag the yellow metal down till $1329 (61.8% fibo)/$1324.

It is good to buy on dips around $1345-47 with SL around $1338 for the TP of $1355/$1364