- Gold prices trades in narrow range between $1289 and $1306.50 for the past three weeks. The major focus is on US President and North Korean leader Kim Jong Un which is to be held on Jun 12th.. The summit will be the first meeting between Kim and Trump after a six years of isolation from world’s stage. US 10 –year bond yield has slightly declined after hitting of 2.99%. USDJPY recovered sharply despite G7 meeting failure. The pair jumped till 110.06 and is currently trading around 110.04. The yellow metal hits high of $1303 previous week and is currently trading around $1297.28.

- The major three factors to be watched for gold price movement are

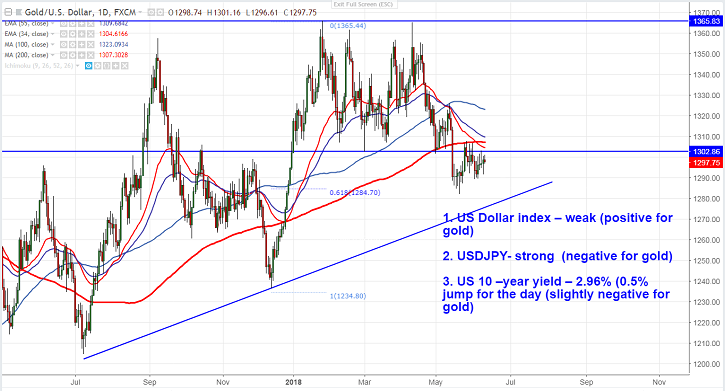

- US Dollar index – weak (positive for gold)

- USDJPY- strong (negative for gold)

- US 10 –year yield – 2.96% (0.5% jump for the day (slightly negative for gold)

- The yellow metals near term resistance at $1307 (200- day MA) and any convincing break above will take the yellow metal till $1316 (55- day EMA)/ $1324 (50% fibo).

- On the lower side, near term support is around $1289 and any break below will drag the yellow metal down till $1280/$.

It is good to buy above $1308 with SL around $1300 for the TP of $1324/$1330.