- Gold prices has shown a minor recovery of more than $10 from the low of $1292 made this week on account of weak US dollar. Euro jumped more than 150 pips from the low after Italian President gives populist more time to form a government. Euro appreciated since chance of new elections are less in Italy. Italy 2- year bond yield came slightly below 2% after surging more than 150 basis point on Tuesday. Italy Credit default swaps jumped by 59% to 262 bps, the highest level since Oct 2013. The upside momentum is capped due to strength in US dollar index. DXY has shown a decline of more than 100 pips from the high of 95.03.It is currently trading around 93.93. The yellow metal hits high of $1306.49 and is currently trading around $1305.

- The major three factors to be watched for gold price movement are

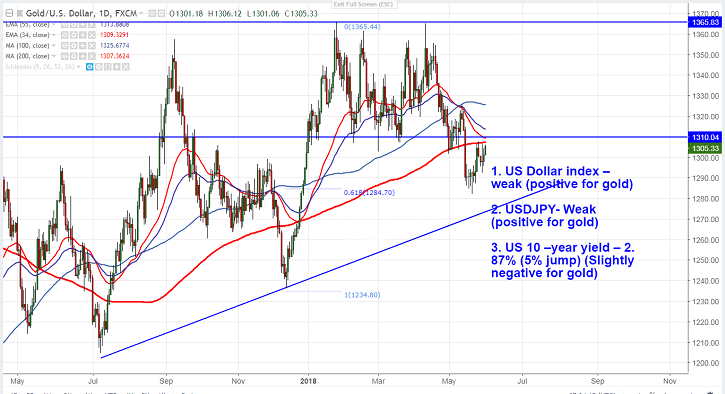

- US Dollar index – weak (positive for gold)

- USDJPY- Weak (positive for gold)

- US 10 –year yield – 2.87% (5% jump) (Slightly negative for gold).

- The yellow metals near term resistance at $1307 (200- day MA) and any convincing break above will take the yellow metal till $1316 (55- day EMA)/ $1324 (50% fibo).

- On the lower side, near term support is around $1294 and any break below will drag the yellow metal down till $1285/$1280.

It is good to buy on dips around $1295-97 with SL around $1290 for the TP of $1308/$1316.