- Gold has shown a good selling of almost $18 from the high of $1356.76 made yesterday. The major reason for decline in yellow metal was due to minor dip in safe haven demand as US – China trade war started to ease. The yellow metal hits low of $1339.75 and is currently trading around $1340.72.

- US dollar index shown a minor recovery after hitting low 88.94. The index jumped till 89.63 and is trading around 89.44.

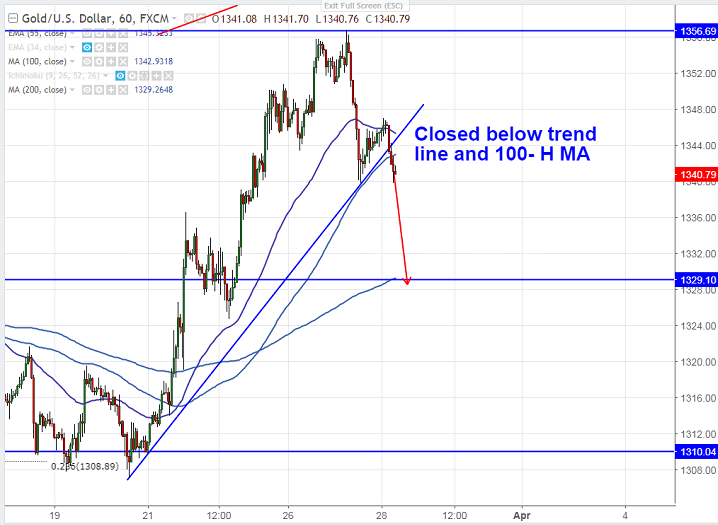

- The yellow metal is facing major resistance at $1362 and any minor bullishness only above that level. Any break above $1366 confirms bullish continuation. The minor resistance $1348/$1355.

- On the lower side, near term support is around $1338 and any break below will drag the yellow metal down till $1334/$1329.

It is good to sell on rallies around $1342-43 with SL around $1348 for the TP of $1331.