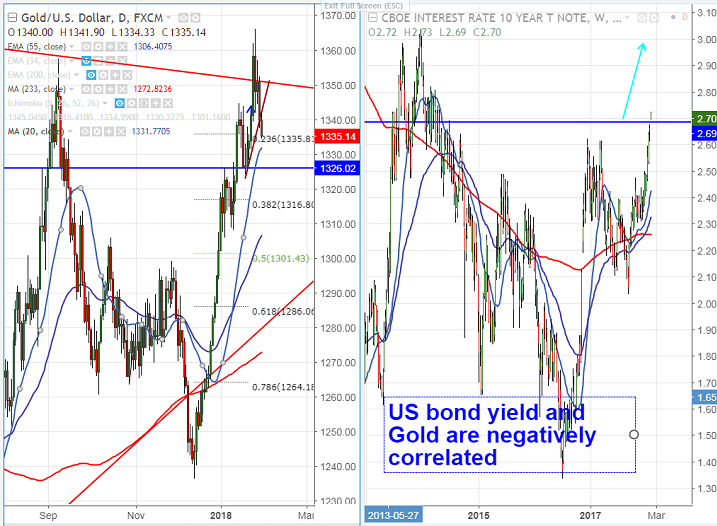

- Gold has declined almost $18 from the high of $1352 formed yesterday. The yellow metal selling was mainly due to rise in US yields and slight recovery in US dollar. US dollar index has recovered more than 100 pips from the low of 88.44. It is currently trading around 89.46.

- US 10 year yield rose above 2.70% for the first time since 2014.Markets awaits Fed policy meeting which is to be happen on Wed. Any hawkish statement by Fed would be supportive for US dollar and bond yields.

- The near term support is at $1330 (20- day MA) and any violation below will drag the metal to next level till $1320/$1316.50 .Major weakness below $1330.

- On the higher side near term resistance is around $1340 (10- day MA) and break above targets $1347/$1355. Bullish continuation only above $1365.

It is good to sell on rallies around $1337-39 with SL around $1347 for the TP of $1324/$1316.