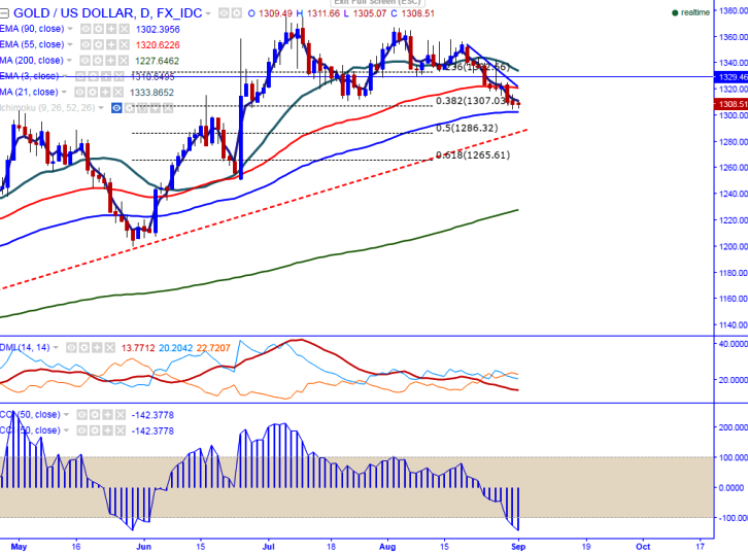

- Major resistance- $1323 (9-day EMA).

- Major support- $1302 (90 day EMA).

- The yellow metal has declined till $1304 yesterday after breaking previous day low of $1308.80.It is currently trading around $1308.25.

- The intraday resistance is around $1313 (3- day EMA) and any violation above will take the commodity till $1323 (9- day EMA)/$1330 (61.8% retracement of $1308.80 and $1342.26). It should close above $1340 for further bullishness.

- Technically the support is around $1302 and breaks below targets $1296 (100 day MA)/$1285.

It is good to sell on rallies around $1313-1315 with SL around $1323 for the TP of $1300/$1295