This is what was advised exactly a week ago, 1 leg of strategy has derived as desired. Please refer below link for further readings:

Those who’ve placed this strategy then, by now US$ 1707.96 must have been added in your kitty.

Because, your shorts would go worthless now with shorter expiries as it happened in (1%) ITM shorts.

On the flip side, existing longs on (1%) OTM calls with expiries of 22 days remaining are likely to serve hedging any upside risks.

Technically, the gold price has broken below rising wedge base on daily chart at around 1240 levels, as a result, bearish swings now slipping through sloping channel. Currently, facing channel resistance at 1231 levels. The price of this precious metal to range in 1200 on south and 1250 on northwards in next week or so.

Gold for June delivery on the Comex division of the NYME stapled on $6.40, or 0.52%, to trade at $1,230.20 a troy ounce after Fed minutes on interest rate hikes which hinted unlikely to hike in April owing to global economic risks.

Hence, for fresh bullion traders, the right strategy to deal with this puzzling trend is to continue with the “credit call spreads” that we’ve already advocated a week ago.

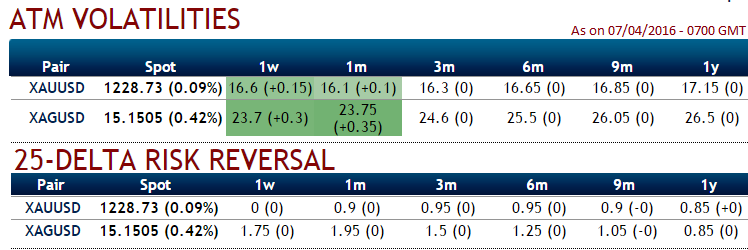

Since, 1W ATM IVs of gold contracts are at 16.6% and with neutral risk reversals, we think below options positions are the best suitable in prevailing OTC atmosphere.

So, go long in 1M (1%) OTM call, while writing 1W (0.5%) ITM call. This strategy likely to best serve the swings explained above.