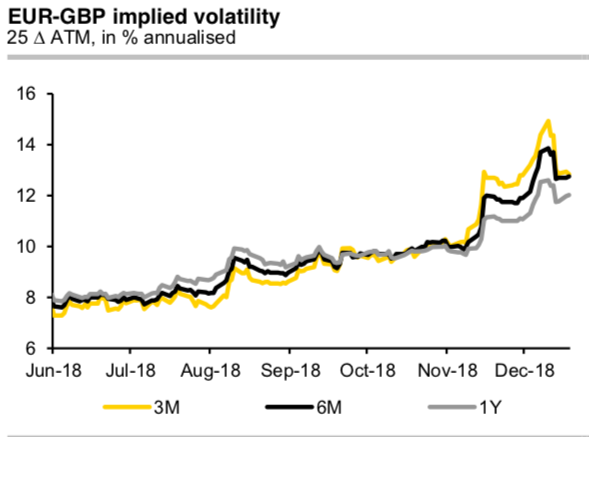

Although the recent fall in GBP volatilities on the options markets (refer above chart) does not really make total sense, a question pops-up in our mind, has the uncertainty concerning Brexit really fallen in the eyes of the market since the vote in the House of Commons was postponed? Of course, it was clear that Prime Minister Theresa May would lose the vote on her withdrawal agreement.

However, if the vote had taken place the deal would have finally been off the agenda and we would have made a tiny little bit of progress. May will now spend the next four weeks, as she herself has explained, somehow trying to save her deal by trying to get some assurances from the EU 27 about the Irish backstop.

The quieter sentiment on the markets has got one major advantage. For all those who may not have hedged their GBP risks yet, the current situation provides a reasonably attractive entry level.

FX Options Strategy (Stay short EURGBP though a ratio put spread): In early November, we sensed that the UK was close to securing a negotiated and therefore somewhat reassuring exit from the EU. We positioned for a modest albeit distinctly bounded relief rally in GBP through a ratio put spread.

Please be noted that the positively skewed IVs of this pair is also indicating the upside risks, while risk reversals are also signaling the same.

Hold a 2m 1x1.5 EUR put/GBP call spread, 0.87- 0.8550 with an 0.84 RKI on the lower strike. Expiry January 3, 2019. Paid 39bp in November. Marked at 2bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 102 levels (which is bullish), while hourly GBP spot index was at -34 (bearish) while articulating at (11:25 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different