The bearish AUDUSD scenario below 0.75 if:

1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation;

2) The Fed responds to firm labor market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially.

The bullish AUDUSD scenario above 0.80 given that:

1) China eases policy and commodities rebound;

2) The Fed’s tightening timeline is severely disrupted by further downside surprises on inflation; or

3) The RBA adopts a more hawkish tone to its communications.

Some consolidation between 0.7750 and 0.7800 following a 5% fall over the past month and a recent stall in the USD.

AUDUSD in medium-term perspectives: If the RBA maintains status quo firmly, as we expect, and the US dollar likely to rise on the delivery of a Fed interest rate rise in December, then AUDUSD could fall to 0.76 by year-end.

Hedge using Reverse Put Spreads:

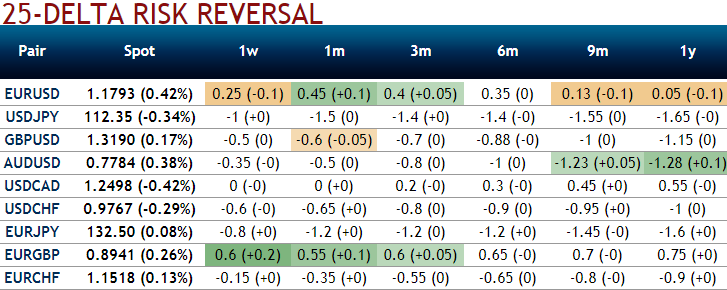

OTC outlook: Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes upto 0.7550 levels (refer above diagram). While bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Well, the bearish stance has been substantiated by AUDUSD's rising IV in 1-3m which is an opportunity for put longs in long-term and using shrinking IVs of shorter tenors with bearish neutral delta risk reversal can be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Consequently, we advocate the reverse put spreads contemplating short leg has to function as the underlying spot FX keeps spiking abruptly but keeping the major downtrend in consideration.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price spikes to bidding theta shorts in short run and 3m IV positive skewness and risks reversals to optimally utilize Vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 2m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data