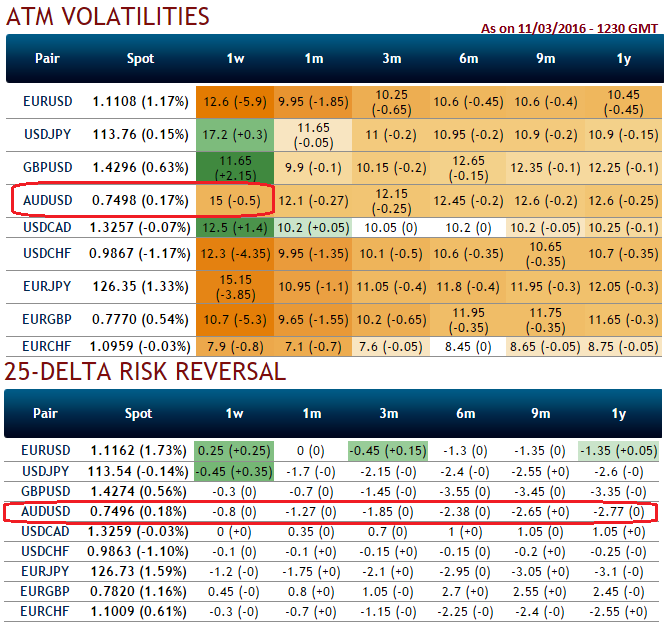

AUD/USD is currently the highest implied vols among G20 currency space after USDJPY for 1w expiries and top ranked for 1y tenors or any EM basket and same is the case with realized vols (see IV & risk reversal nutshell), proven one of the improved gamma buys of 2015 also, thanks to an outsized 12% decline in the currency and 10.25% recovery within last 3 months.

The Aussie dollar has been slowly drifting lower when the pair is attempting to hit above resistance level, in a narrow range mild Asian data season on Friday in anticipation of the release of industrial output and retail sales data from China to set the tone.

Both industrial production and retail sales in China is forecasted to drop at 5.6% and 10.9% from 5.9% and 11.1% respectively.

Subsequently, we expect AUDUSD drop again, so foreign trader whose short term payables in Aussie dollar can go opt below hedging strategy.

Given that implied volatility is one of the most significant determinants of an option's price, we use it as a proxy for market demand for a specific option. Thus if we compare implied volatility levels across a series of options, we can get a sense for trader sentiment on a direction for a specific currency pair.

In line with our preference to sell rich yen skews, we advocate financing AUD/USD 3M straddles by selling 1Y 25D AUD puts /JPY calls in vega-neutral amounts.

The technical set-up of the RV is appealing in terms of entry levels, and realized vol spreads look asymmetrically biased in the direction of AUD/USD outperformance.

Selling cross-vol/buying USD-correlation also fits with a market environment that is likely to be dollar-centric in the early stages of the Fed cycle.

FxWirePro: Hedge Aussie dollar long term risks via AUD/USD 3M ATM straddles offset with AUD/JPY 1Y ATM puts (delta-hedged)

Friday, March 11, 2016 2:43 PM UTC

Editor's Picks

- Market Data

Most Popular