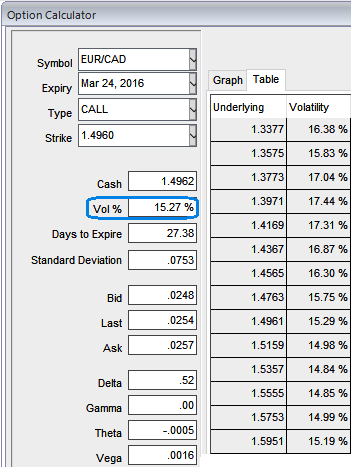

ATM vols have been spiking higher above 15%, the rationale is that any potential downswings should be optimally utilized to maximum extent, so to participate in that downtrend, weights in the portfolio should be increased with more put contracts.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good.

Technically, we see more downside potential on this pair as the bulls could not hold onto the recent peaks of 1.5914 but claims more dips further to break below neckline at 1.5100 levels to signify more weakness with both leading and lagging indicators to converge this selling pressure. Hence, we could foresee southward journey, probably below 1.45 sooner.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

The Strip requires a specific symmetry in the expiry months in that the time difference between the expiry months is the same for all legs.

Hedging Strategy: Option Strip Construction (EURCAD)

How to execute:

Go long in 1M at the money EURCAD -0.49 delta put option.

Go long in 1M (1%) out of the money EURCAD -0.39 delta put option.

Go long in 1M (1%) in the money EURCAD -0.58 delta put option.

Go long in 1M at the money EURCAD 0.51 delta call option.

Go long in 1M (1%) out of the money EURCAD 0.39 delta call option.

Huge profits achievable with the strip strategy when EURCAD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move as you should also note short-dated options are less sensitive to IV, while long-dated are more sensitive. The profitability can be maximized for every shift towards downside and this is not the same on upside.

FxWirePro: Hedge EUR/CAD risks via option strips in 3:2 on higher IVs with more downside potential

Friday, February 26, 2016 6:40 AM UTC

Editor's Picks

- Market Data

Most Popular