Technicals Watch: The pair has been bouncing from last 3-4 days after testing supports at 121.680. Upswings favoured by momentum that signalled by leading oscillators, but longs accepted only above resistance at 123.1134 (7DMA) as major trend which is bearish is still remains intact. So short term bulls have to wait until it breaches resistance at 123.1134 levels.

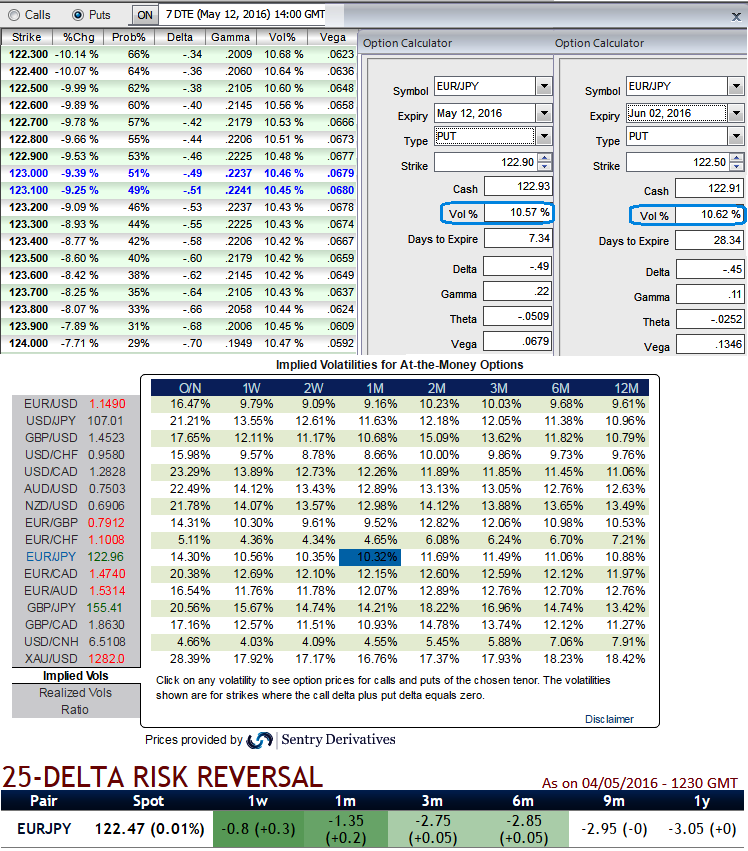

OTC Updates: The implied volatility of ATM contracts is at 10.44% for 1w expiries and for one month expiries is at around 10.34% which is reducing in long run as well.

As you can see ATM calls are priced in 15% more than Net Present Value for 1W expiries, whereas IVs just above 10% and it is likely to reduce, hence, it is deemed as disparity between pricing and OTC market sentiments.

As we acknowledge the gradual decrease in the implied volatility of EURJPY, but with higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see Sensitivity table, IVs and RR nutshell and compare this with spot prices).

Major trend is declining trend, from last two years or so the pair has evidenced price dips about 19.7%, and we could still foresee more downside potential ahead. You can understand this with the sensitivity tool as the OTM put strikes with higher probabilities along with higher vols, which means that the more chances of these options expiring in the money.

While, this stance is substantiated risk reversal numbers as well, greater negative numbers in long run signify that the OTC market anticipate the more dips in underlying spot in the months to come.

We rely on these delta risk reversal numbers, because -

If the foreign trader is agreeable to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate;

If he wants to lock in a worse but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer.

If he is unwilling to pay or wants to cut down the premium payment as compared to those payable in case of forex options.

Contemplating above aspects, we eye on loading up with fresh longs for long term hedging, more number of longs comprising ATM instruments and ITM shorts in short term would optimise the strategy.

While current IVs of ATM contracts are at higher levels but likely to perceive at an average rate of 10.75% in long run (see 1W-1Y ATM IVs), the strategy goes this way in order to mitigate long term FX risks in this pair,

The Execution:

“Short 2W (1.5%) OTM put option, go long in 2 lots of 1M ATM +0.49 delta put options, thereby net delta should remain at around -0.64.”