OTC outlook and options strategy:

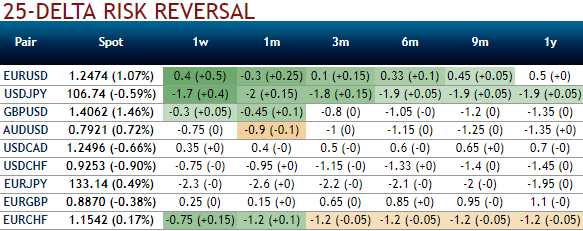

Let’s glance at above nutshell, the positive shift in risks reversals in 1m tenors that indicates the bullish risks in underlying spot FX prices.

Positively skewed IVs of 3m tenors signifies the interests of OTM put strikes (upto 1.3450) that means the ATM puts have the higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in shorter tenors that are favorable to both call and put options holders’ advantages.

Bearish neutral risk reversals indicate hedgers still bid for downside risks. ATM IVs are trending between 9.74-10.20% range for 1-3M tenors.

Hence, in order to arrest both upside risk that is lingering in intermediate trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 1M ATM 0.51 delta calls and 2 lots of ATM -0.49 delta puts of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 20 levels (which is bullish). Hourly USD spot index was at shy above -58 (bearish) while articulating (at 08:47 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms