New Zealand's upbeat GDP reduces prospects of OCR cut, so as US CPI for Fed hikes.

NZ produced the upbeat GDP QoQ numbers last week, actual 0.7% versus forecasts at 0.5%.

On the flip side, Fed’s deferral on rate hiking cycle due to various considerable reasons (especially US CPI, job market pressures and global slowdown) may hamper dollar prospects.

US CPI MoM prints at 0.2% versus forecasts at 0.3% and previous 0.4%.

As a result, if not in near terms we could foresee uncertainty on both sides of central banks who are likely to deliver changes in their respective monetary policies, as the long term downtrend has given trend reversal signal or it is just puzzling.

Well, technically although this pair has broken major resistances at 0.6896 levels and DMAs to evidence considerable price bounces further.

Hedging Framework: Spread ratio: (Long 1: Long 1: Short 1)

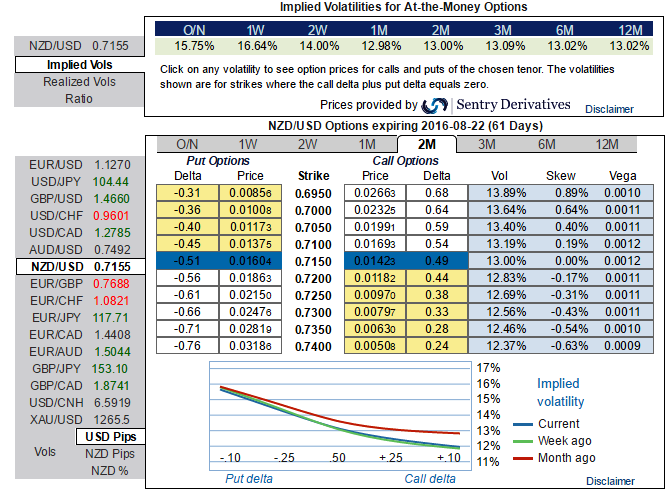

While the implied volatilities of 1m NZD/USD ATM call options are at 12.98% and likely to perceive at 13.09% in next 3m tenors.

With trend puzzling on either direction we like to advocate 3-Way Options straddle versus put option.

How to execute: Go long in NZD/USD 3M At the money delta put, Go long 6M at the money delta call and simultaneously, Short 1M (1.5%) out of the money puts.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data