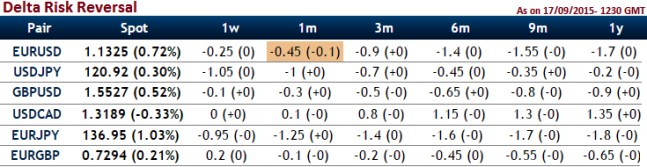

Rationale: From the table showing delta risk reversal and below technical indications, the real challenge depends on a smart interpretation of these numbers and scrutiny of trend. The delta risk reversals of 1W to 1M contracts has almost shifted into neutral to negligibly positive in the uptrend of this pair, so how could this be interpreted this shift in hedging sentiments, the neutral delta risk reversal when we have to compare this with historical values would mean that slight dubious attitude is seen in bulls of this pair.

Technical glance: The formation some bearish pattern candles on this pair are piling up some sort of selling pressures, on weekly price behavior we also observed divergence to the previous uptrend on RSI oscillator above 70 levels that signals overbought pressures. %D crossing over above 80 levels on stochastic curves to substantiate this bearish stance. Currently, the pair is lingering at 1.3141, RSI curve is trending at 67.3529 heading towards south, while %D line 89.9453 and %K line at 83.2857. Hence, although it is not going to be steep slumps or long term trend reversal we would still foresee near targets at around 1.2960 areas and can even extend upto 1.2723 levels in near terms with a strict stop loss at 1.3326 levels.

Currency hedging framework: USDCAD

With the above reasoning, we recommend arresting potential downside risks of this pair in medium run by hedging through Put Ratio back Spread while expecting EURUSD to make a downside move.

Hence, purchase 1M 2 lots of At-The-Money -0.48 delta puts and sell 1W 1 lot of (1%) In-The-Money put option usually in the ratio of 2:1.

We set up this strategy contemplating above delta risk reversal indications. The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

The delta of combined positions should be around -0.34 with slightly negative theta value so as to go well with our projections. If a disciplined hedger strictly follows all these mathematical computations, then irrespective of market trends, one can be rest assured with the riskfree exposures in his foreign trades.

FxWirePro: Hedge USD/CAD with PRBS as delta risk reversal projects intermediate term trend reversal

Friday, September 18, 2015 8:18 AM UTC

Editor's Picks

- Market Data

Most Popular