Mexican CPI data for April printed on Monday at 2.54% y/y, with the m/m measure printing at -0.32%. Whilst the data were slightly below expectations, what’s clear is that inflation trends in Mexico are hardly robust, despite the peso’s substantial depreciation over the last 9 months.

The inflation rate has been running below the central bank's 3 percent target since May last year. The central bank expects it to remain below target in coming months but to move temporarily above it by the end of the year.

Judged on its own merits Banxico have little reason to engage in a rate hiking cycle. However Banxico stated they will follow the Fed’s rate hiking cycle, so for the moment markets are still betting on around 75 bps of Banxico rate hikes over the coming two years.

Interestingly, the peso lost ground yesterday along with practically every other EM currency against the USD, following comments from another Fed speaker which seems to point towards June as being a ‘live’ Fed meeting.

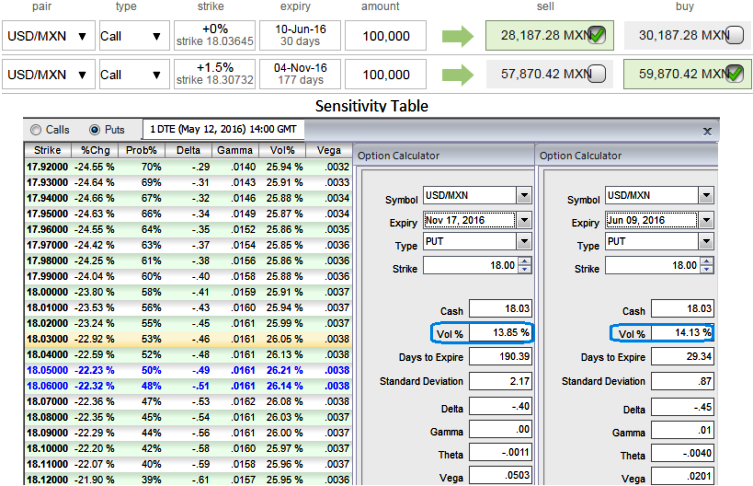

1M ATM implied volatility of USDMXN is perceived to be at 14.13% and it is likely to creep negligibly lower in long run (for next 6 months to 1-year span).

While, OTM put strikes with higher probabilistic numbers have healthy vega with rising IVs.

We have our doubts about this, but in any case we maintain our view that USDMXN should trade around a central tendency of 17.50 over the coming months.

Hence, MXN among few EM currency space typically held in carry basket seem cheap on a real effective exchange rate basis, sell 1M USD/MXN ATM calls vs buy 6M (1.5%) OTM delta calls, use European style options.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data