NZDUSD has formed a double top pattern on daily charts with peak 1 at 0.6897 and peak 2 at 0.6883.

Although this pair has tested supports near neckline of double top at 0.6428, we could foresee more bearish pressure in the weeks to come.

The risk bias to antipodean currencies remains firmly to the downside in 2016.

Well, long-term investors don't get bull trapped in this pair as it is clearly dipping within a southward channel that has moved way below 21DMA with both leading and lagging indicators signal sell in long term.

Thus, the pair carries bearish attitude for 2016 and forecast NZD/USD at 0.59 by Q1 of 2016 and 0.61 by Q4 of 2016.

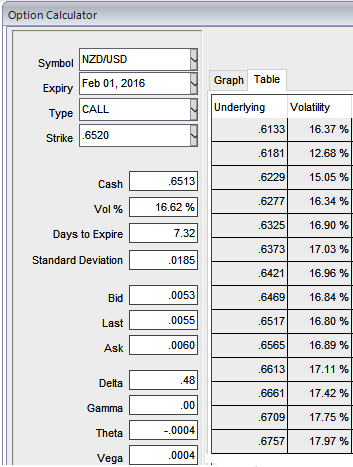

Retrospectively, bearish hedging instruments seem costlier (puts obviously tend to look more expensive), anticipating the above vital fundamentals we build calendar combinations on this pair hedging potential downside risks and strategy also offers speculative benefits as we have shorts on one side when you have higher IVs of 16.62% .

NZDUSD inching higher towards 0.6515 (seeing resistnace 0.6525 or even if it manages to break we don't see maximum upside brackets for another 40-50 pips) but long term bearish trend seems intact. Here, idea is not to go against the trend but on hedging grounds, strategy goes this way:

Since Kiwi dollar's long lasting bears back in action, the recommendation is to buy 1M 2W at the money -0.5 delta put and simultaneously short 4D (0.5%) in the money call with positive theta value and delta close to zero.

The value of an option for every point's movement in the underlying is constantly changing. The Delta can be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option's value will increase or diminish as the underlying market moves.

FxWirePro: Hedging and speculating NZD/USD downside risks via calendar combinations

Monday, January 25, 2016 7:21 AM UTC

Editor's Picks

- Market Data

Most Popular