AUDUSD and NZDUSD vols appear the cheapest within the G10 space, based on the relative-value analysis for ATM vols. As we can see from the below-left chart, Kiwi vol trades near one-year lows and is undervalued by 1.8 standard deviations against its model value (almost a vol point). While volatility premia are currently wide in the G10 space, those on AUD and NZD are amongst the tightest.

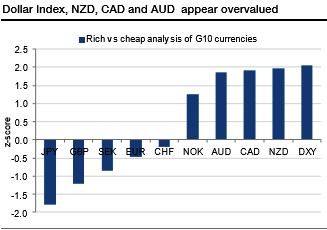

Furthermore, we had seen in the previous chart that the Aussie and Kiwi are possibly overvalued in the spot market and, due to their high-beta, could undergo consistent drops in the event of extended USD appreciation in the next few months. A 6m 25delta put on NZDUSD appears to offer value based on the arguments above.

A second hedge opportunity can be spotted by looking at the EURUSD vol curve. The vol presents a peculiar shape, downward sloping up to 3m and upward sloping from 3m on. The market prices in a higher vol for the 6m maturity due to the uncertainty related to the French election. Still, a long 6m/short 3m vol trade allows for cheapening the cost of the gamma positive long 3m vol trade. By reducing the notional of the 6m leg, the trade can be structured to be gamma positive and vega neutral.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation