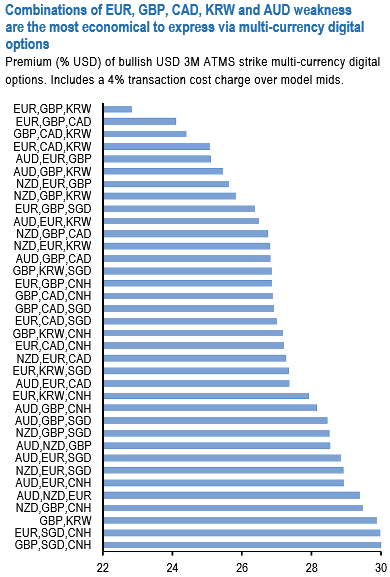

Given that the average investors’ tradable horizon is no more than 3-6 months, and that the bulk of US-policy driven FX moves are likely to be front-loaded in Q1 with some possibility of a reversal/inflection in H2, this analysis uses Q1’17 targets as strikes for 3M one-touch options in the direction of the forecast; smaller the option price, lesser the extent of the market’s view already discounted by option markets.

We are aware that the one-touch option product does not trade liquidly in many EM currencies, but matters less in this context when option pricing is used purely as an analytical tool; real-life trade implementation, if desired, can always take the vanilla option route.

The above chart demonstrates the ranks of USD pairs vs. G10 and EM currencies using the scheme described above, and suggests that bullish USDCAD views (Q1 target 1.40, Q2 1.43) offer the greatest upside, followed by USDINR (Q1 69.75, Q2 70.50), USDZAR (Q1 15.25, Q2 15.10) and Asians such as USDSGD (Q1 1.47, Q2 1.48) and USDKRW (Q1 1230, Q2 1200).

At the other end of the spectrum, CHF, NOK and BRL targets vs. USD are priced into option prices to a large degree, hence, these currencies are better purchased on crosses to provide some thematic relief to portfolios tilted predominantly long dollars.

Please be noted that we are short EURCHF as a constructive franc + European politics hedge, short CADNOK as an oil-neutral trade protectionism/NAFTA renegotiation play and long BRLCOP as a regional Latin RV.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch