The implied volatilities of crude oil options have dropped considerably on the back of last week’s OPEC production cut pact. For an instance, the 3m at the money WTI implied volatility has dropped a massive 10 percentage points to about 33% since the OPEC announcement to cut output by 1.2 Mb/d. As we have mentioned before, we believe that the return of OPEC to active supply management is like to result in 3m implied crude vols trading below 30% to around 25% over time.

Crude stocks drew by 2.4 Mb (vs. -1.5 Mb expected), while Cushing saw a 3.8 Mb build (vs. +0.3 Mb expected). Imports jumped by 755 kb/d to 8.30 Mb/d, back from relatively low levels the preceding two weeks. Refinery runs rose by 134 kb/d to 16.42 Mb/d, while 4w av. runs declined by 172 kb/d to 16.31 Mb/d (-1.0% y-o-y). Production was flat at 8.70 Mb/d, with lower 48 output edging down by 2 kb/d. Stocks remained far above 5y highs.

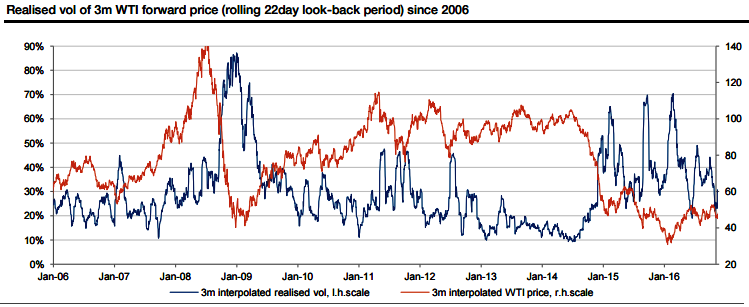

The chart above shows the daily realized vol of the 12-month WTI forward price since 2006. We believe that 2017 will share similarities with the 2010/11 period when the oil market was recovering from the 2008/9 oversupply helped by OPEC cuts.

Back then, the 3m realized vol dropped below 30% during most of 2010 and H1’2011. Please note that the realized vol in the chart is calculated using a rolling 22-day look-back period.

The short (but standard) look-back period makes the realized vol quite volatile. The 3m implied vol tends to be much less volatile than the 3m realized vol using the standard 22-day look-back period.

Despite the OPEC deal and the jump higher in oil prices, consumer hedging activity has remained muted while producer hedging, mainly by US producers, has continued. This suggests that the longer-dated risk-reversals will remain very skewed with the implied vols of out-of-the-money puts trading well above out-of-the-money calls. Indeed, the 12-month WTI and Brent 25-delta risk-reversals (put minus call) are trading at multi-year highs.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data