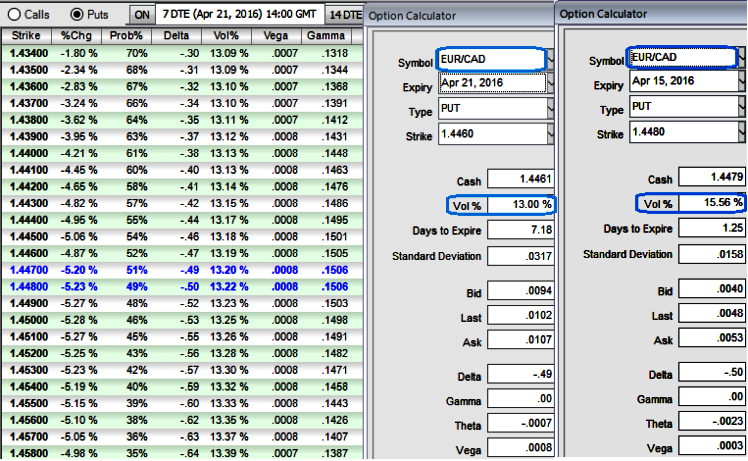

ATM IVs of EURCAD is rising at 13% for 1w expiries,

You may probably know that the options prices are usually directly proportionate the corresponding implied volatility. A security with a higher volatility will have either had large price swings or is expected to, and options based on a underlying FX pair with a high volatility will typically be more expensive.

Well, now have a glance on another important Option Greek that determines relation between premiums & IVs. Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

In sensitivity table it is understand that OTM strikes with higher probabilities and constant IVs displays reasonable Vega.

This is instinctive because the higher likelihood of the underlying spot FX 'swinging' in your favour if you've chosen OTM strikes. If IV increases and you are holding an option, this is good.

We could foresee more downside potential while monthly plotting of technical charts, bears claim more dips by breaking important supports to signify more weakness with both leading and lagging indicators to converge this selling pressure.

The rationale is that any potential downswings should be optimally utilized to maximum extent, so to participate in that downtrend, weights in the portfolio should be increased with more put contracts.

A smart approach to deal with this trend is that potentially profit from volatility. The simplest way to do this is to buy at the money contracts.

The Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM. But in this case we see no changes at all, which means as ATM options grow into expire in the money (as per the sensitivity tool), deltas should also be increased.

This is how ATM instruments are more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.