This week we examine local currency bank loan and deposit trends across the region. Similar to the deleveraging in external debt noted in last week’s focus, domestic loan growth has remained relatively weak, likely reflecting softer credit demand resulting from subdued economic growth and declining trade growth. Slower loan growth has kept loan-to-deposit (LDR) ratios broadly flat in the region ex. China and India.

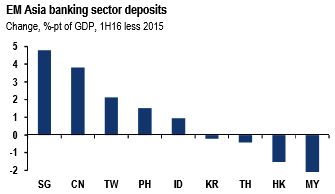

In Asia, the declines in local currency deposits have stabilized somewhat as demand for FX deposits decreased and USD depreciation broadened in the first half of the year (see above diagram).

With the next Fed rate hike appearing imminent, USD has strengthened notably in recent weeks, which if sustained may limit local currency deposit growth and keep banking system liquidity tight in the region.

We advocate investors having neutral exposure to EM FX and refraining from large risk allocations heading into the US election. Our portfolio of trade recommendations should be well insulated in either scenario, focusing on a mixture of short and long USD trades and inter-EM relative value positive carry structures.

In Asia, we like short USDIDR and long USDTWD and relative value positive carry structures that include short MYRIDR, short SGDINR, and long INRKRW.

In China, we continue to recommend owning 1-year USDCNH seagull structures and shorting CNH against an abridged CFETS basket.

Apart from Asian pool, the favorite Trump hedge is to own a USDTRY 3.16 call with a KO at 3.41.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation