EURGBP moved slightly lower and Gilt yields ticked 4bp higher driven by the more hawkish tone in the statement, where Kristin Forbes voted for a 25bp rate hike this time. Note, however, that Forbes is a known hawk and leaves the BoE this summer.

• The market is now pricing in an accumulated 8bprate hike from the BoE in 2017 and 26bpby the end of 2018. We still think the market’s pricing is too hawkish, suggesting little support for the GBP driven by higher UK interest rates ahead. Hence, relative rates, in our view, favor lower GBPUSD, as the Fed is slightly underpriced, while risks stemming from relative rates are more balanced for EURGBP, as the market has turned too hawkish on the ECB pricing as well, with a 10bp rate hike priced by March 2018.

• EURGBP has fallen back below our 1-3M target of 0.87. As such, we still see risks skewed on the upside for EURGBP, as we expect GBP to underperform vis-à-vis the USD and EUR in coming weeks and following the triggering of Article 50.

• However, the Brexit risk premium priced on GBP has increased over the past two to three weeks and, given that investors are very short GBP, according to IMM, further GBP short covering could pave the way for a short-term correction lower in EURGBP.

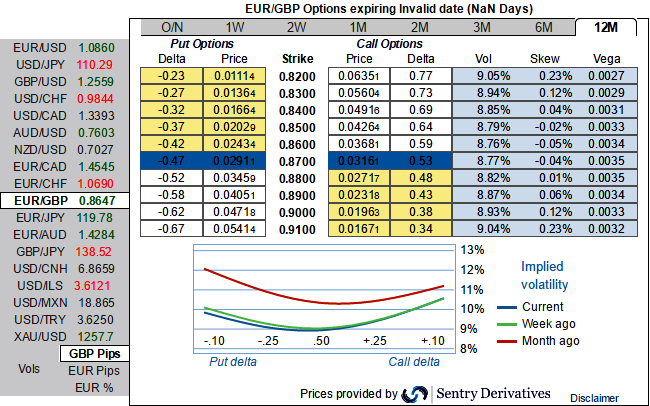

Please be noted that the IVs and skews are conducive for call option holders.

As you can probably guess from the positively skewed IVs across all tenors (inclusive of 1Y tenor) signifying the hedgers’ interests for upside risks, as a result OTC market environment lures OTM call option holders’ opportunities. While an option holder wants higher IV or IVs to spike further so that the premium would also grow higher accordingly which could be the conducive case here if we have to evaluate OTC tools.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook