As we see some downside potential now in short terms on this yellow metal as the bulls could not hold onto the recent peaks of 1303.68. As a result, we could see shooting star pattern at peaks of 1291.34 levels with leading oscillators signalling momentum in selling pressures. But remember this could only be for short term.

XAU/USD futures for June delivery on the Comex division of the NYME jumped $10.40, or 0.82%, to trade at $1,284.80 a troy ounce by 13:35 GMT.

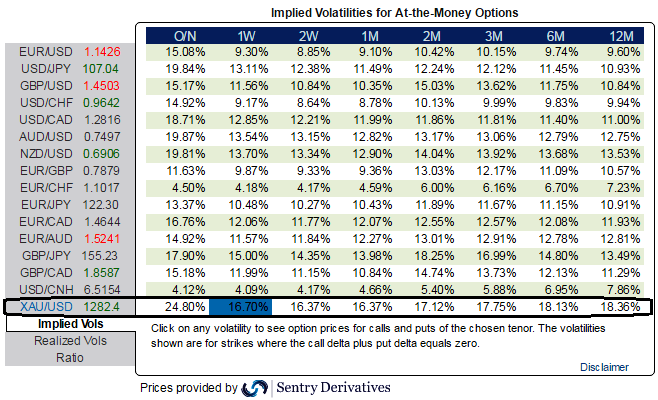

As we were strategising hedging frameworks in gold’s uncertainties, we came across the implied volatility of 1W ATM contracts are spiking higher than 16.7% and more than 18% for next 6 months tenors, the rationale is that any major trend should be optimally utilized to the maximum extent.

So to participate in that major trend (be it uptrend or downtrend), weights in the hedging portfolio should be increased proportionately favouring the trend.

Implied volatility is an important factor to consider in options trading, because the prices of options are directly affected by it.

An underlying commodity prices with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good.

A smart approach to tackle this obstacle and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts.

Delta neutral strategies are options strategies that are designed to create positions that aren't likely to be affected by small movements in the price of a security. This is achieved by ensuring that the overall delta value of a position is as close to zero as possible.

Delta value is one of the Greeks that affect how the price of an option changes.

Strategies that involve creating a delta neutral position are typically used for one of three main purposes.

- Profiting from Time Decay

- Profiting from Volatility

- Delta Neutral Values in hedging

The effects of time decay are a negative when you own options, because their extrinsic value will decrease as the expiration date gets nearer.

By writing options to create a delta neutral position, you can benefit from the effects of time decay and not lose any money from small price movements in the underlying security.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed