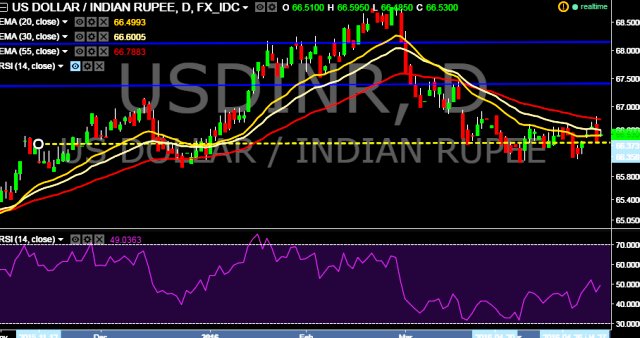

- USD/INR is currently trading at 66.53 marks.

- It made intraday high at 66.59 and low at 66.48 levels.

- Intraday bias remains neutral for the moment.

- A daily close below 66.62 will take the parity down around key supports at 66.47/66.32/66.10/65.95 levels respectively.

- On the top side, key resistance levels are seen at 66.72/ 66.86/ 66.95/ 67.15 levels.

- In addition, Indian stock markets are trading on a mix note. As BSE Sensex was trading 0.01% lower at 26,004 while NSE Nifty up by 0.09% to 7969 points.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.