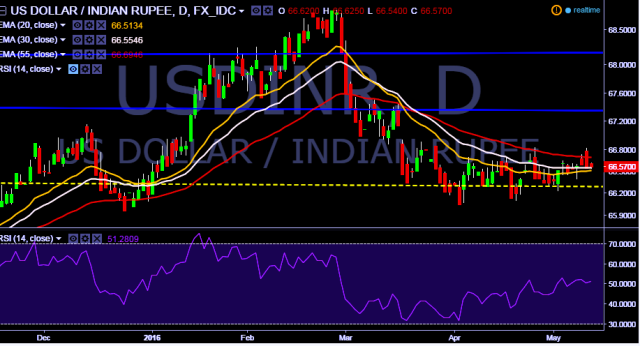

- USD/INR is currently trading around 66.57.

- It made intraday high at 66.62 and low at 66.54 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 66.72 marks.

- A daily close below 66.56 will take the parity down around key supports at 66.42(May 01, 2016 low) /66.32 (November 2015 low) /66.23/66.10/65.95/65.81 marks respectively.

- On the other side, key resistance levels are seen at 66.84 (55D EMA)/ 66.95/ 67.17 (December 14, 2015 high) levels respectively.

- In addition, Indian stock markets are trading on a positive note. As BSE Sensex was trading 0.52% higher at 25,721 while NSE Nifty up by 0.54% to 7,890 points.

We prefer to take short position in USD/INR only below 66.52, stop loss 66.74 and target 66.32 levels.