The long-awaited rebalancing of the global oil markets is at hand. Although oil inventories remain high globally, non-OPEC supply, led by declining US crude output, is falling. Based on this, as well as solid global demand, we anticipate slight global stock draws in H2 2016 and significantly bigger global stock draws next year.

We are cautious on the near-term price outlook due to downward pressure as crude returns from disruptions. However, we become more bullish as we progress through next year, when we forecast steadily increasing prices driven by global rebalancing.

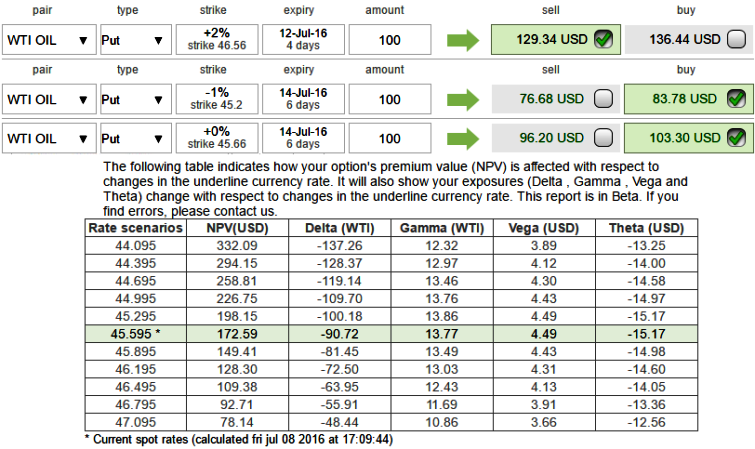

The WTI oil is currently trading at around $45.52; the hedger who is bearish on this commodity executes 2:1 put back-spread by initiating following trades.

Let’s just suppose hypothetical scenarios contemplating prevailing major downtrend of WTI crude.

Calling for 43.36 or below levels in medium run, and shorting a near month 4D (2%) in the money put for $129.34 and go long in 2 lots of the same near month contracts 1W (1%) In The Money & At the money delta puts for around $187.08.

So thereby the net debit would be reduced to enter the strategy and any potential downswings would be taken care by 2 lots of puts.

We can see the gamma difference at current spot reference, for dip in the underlying price of the commodity which means the rate of change of the Delta with respect to the movement of the rate in the underlying market. But it is even better if the dips occur after 4 days as we have a short position in the strategy.

In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

A smaller Gamma means the Delta is less likely to change as the underlying market moves.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary