To all our dear readers, we would like to wish you a Merry Christmas and a Happy New Year in advance. Bond markets will shut early at 1pmET on December 24th and December 31st.

On the eve of this festive occasion, the drop of USDJPY 1Y vol below 8.0 even as macro markets were buffeted by a near-recessionary trifecta of yield curve flattening, credit spreads widening and sell- off in equities over the past two months has not escaped investors’ attention. 8.0 is not a line in the sand for 1Y yen vol by any stretch; we are through this year’s January lows, and the mid-2014 trough of 7.0 looms as the next major target, beyond which there is still substantial room to fall to re-test pre-GFC levels in the 6s. It is difficult to argue with option prices steadily softening when spot is stuck in a tight 112-114 range and delivering 2-2.5 pts. below implieds. There is also a case to be made that the ongoing softness in yen realized vols can continue longer than some anticipate, since the propensity of the yen to rally in market downturns is being dampened by cyclically wide US – Japan interest rate differentials that we reckon are fuelling above-average investment outflows and reduction in FX hedge ratios of traditionally well-hedged foreign bond purchases. Anecdotal evidence suggests that such realized vol drags are being exacerbated by drip supply of vega from Japanese importers who are re-loading / adding to USD-buying FX hedges with embedded short optionality on downticks in USDJPY spot.

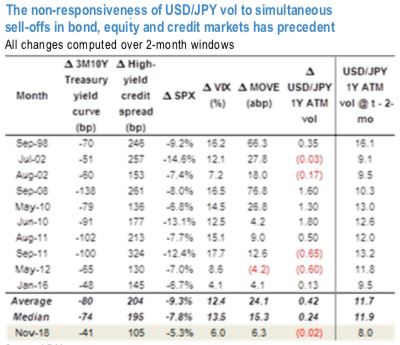

Finally, the insensitivity of yen vols to recent macro developments is not without historical precedent. The above nutshell shortlists a handful of months that experienced risk-off moves in yield curves, credit spreads and SPX over the past 25 years equal to or greater than that of the past two months, and shows that 4 out of the 10 episodes before this year saw yen vol fall rather than rise in response to macro risk-off triggers, though admittedly all from initial levels well north of the current 8%.

None of this is to detract from the fundamental strategic case for yen vol ownership in 2019. If 2019 proves to be the late-cycle trading environment that we expect, FX vols in general have a better-than-even chance of climbing steadily higher through the year and yen as a well-established low-yielding funding currency could potentially realize significant volatility through the broad de-risking that such market conditions are likely to sponsor.

The BoJ offered no surprises as it decided to leave monetary policy unchanged via a 7-2 vote; as before, policy board members Harada and Kataoka were the two who voted against. Forward guidance language was unchanged as well noting that "the Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time, taking into account uncertainties regarding economic activity and prices including the effects of the consumption tax hike scheduled to take place in October 2019". The press conference also offered little in the way of surprises, though Kuroda said it would not be a problem if the 10y JGB yield fell into negative territory, as long as it remained within the target range of 0% +/- 20bp. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 149 levels (which is bullish), hourly USD spot index was at 37 (mildly bullish) while articulating at (09:12 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand