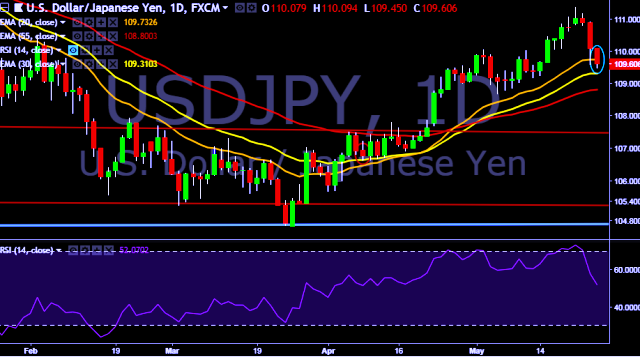

- USD/JPY is currently trading around 109.63 marks.

- It made intraday high at 110.09 and low at 109.45 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 110.92 marks.

- A daily close above 110.07 will take the parity higher towards key resistances around 110.92, 111.40, 111.87, 112.56 and 113.44 levels respectively.

- On the other side, a sustained close below 110.07 will drag the parity down towards key supports around 108.54, 107.65, 106.98, 106.61 and 105.98 levels respectively.

- Japan May Reuters Tankan Index increase to 22 vs previous 21.

- Tokyo's Nikkei share average opens down 0.30 pct at 22,621.29.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest