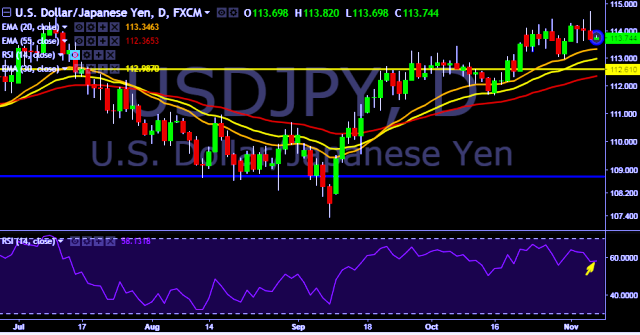

- USD/JPY is currently trading around 113.75 marks.

- It made intraday high at 113.82 and low at 113.69 levels.

- Intraday bias remains neutral till the time pair holds key support at 113.69 marks.

- A daily close above 113.69 will take the parity higher towards key resistances around 114.17, 114.88, 115.50, 117.21 and 118.18 levels respectively.

- On the other side, a sustained close below 113.69 will drag the parity down towards key supports around 112.95, 111.99, 111.47, 110.99, 109.88, 108.12, 107.32, 106.72, 106.03 and 104.96 levels respectively.

- Japan Sep overtime pay decrease to 0.9 % vs previous 1.5 %.

- Tokyo's Nikkei share average opens down 0.13 pct at 22,518.75.

- Japan Sept total cash earnings mark fastest gain since July 2016.

- Japan inflation-adjusted real wages down for fourth straight month.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest