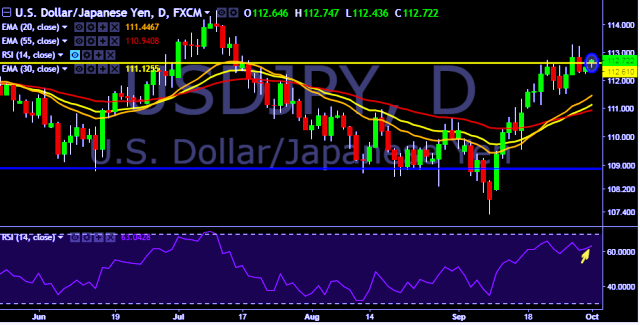

- USD/JPY is currently trading around 112.79 marks.

- It made intraday high at 112.79 and low at 112.43 levels.

- Intraday bias remains slightly bullish till the time pair holds key support at 112.21 marks.

- A daily close above 112.46 will take the parity higher towards key resistances around 112.86, 113.57, 114.88, 115.50, 117.21, 118.18, 118.66, 119.52 and 120.46 levels respectively.

- On the other side, a sustained close below 112.21 will drag the parity down towards key supports around 111.47, 110.99, 109.88, 108.12, 107.32, 106.72, 106.03 and 104.96 levels respectively.

- BOJ September Tankan - Big manufacturer’s index +22 (poll: +18).

- Japan Q3 tankan big non - manufacturer’s index stays flat at 23 (forecast 23) vs previous 23.

- Japan Sep Nikkei manufacturing PMI increase to 52.9 vs previous 52.6.

- Tokyo's Nikkei share average opens up 0.22 pct at 20,400.51.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest