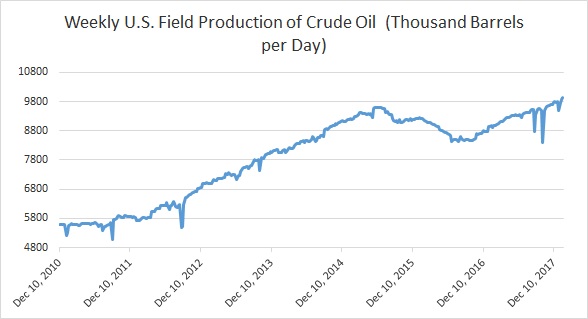

Here are some key charts based on data from United States’ Energy Information Agency (EIA) that explains the level of inventories, refinery demand, and production.

- Chart 1 shows crude oil production in the United States which has reached an all-time high last year, rose sharply to 9.92 million barrels per day last week compared to 9.88 million barrels per day in the week before.

- Chart 2 has been making the refiners around the world cheer and filling OPEC with joy as it shows that distillate inventories have declined significantly and fallen to the 5-year average. However, it has been rising over the past few weeks. However, last week, it rose again to 137.9 million barrels.

- U.S. oil imports have been declining over the past couple of year. However, Chart 3 shows that imports rose last week to 8.43 million barrels per day.

- Chart 4 shows the level of U.S. crude oil exports, which has fallen from a record high of 2.113 million barrels per day. Last week export was 1.765 million barrels per day.

- Chart 5 shows U.S. refinery operating at 88.1 percent capacity.

- Chart 6 shows the level of crude oil inventories, which has declined around 114 million barrels since March 2017. However, last week it rose to 418.4 million barrels, first increase since November.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed