We are medium-term bearish ZAR, but following the sharp sell-off in recent weeks we do not hold active short positions at the moment.

Political risks are likely to be a key driver of the currency, in the near term. It is unclear if Finance Minister Gordhan would remain in his post. Additionally, there is a risk the tensions in the government may decrease policy credibility.

Sovereign credit ratings downgrade risk has also risen.

ZAR experienced a sharp selloff following the latest flare-up in domestic political risks with an increased likelihood that Finance Minister Gordhan may be charged by the police unit.

The sell-off reached about 10% at its peak, matching the correction experienced during the removal of Finance Minister Nene in December 2015.

We held a short ZAR position heading into the event and took profits on August 30.

On the USDZAR front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

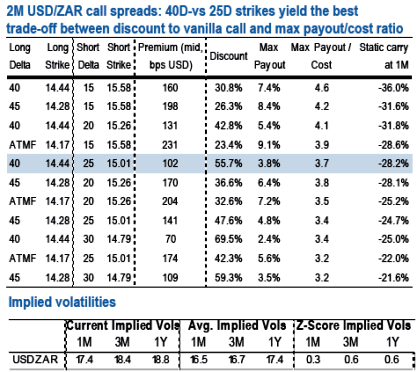

In naked vanilla form, we suggest call spreads at the 2M horizon, optimizing strikes for leverage. In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly.

Therefore the premium for owning US elections risk isn't punitive, and the short leg further mitigates the cost of gamma.

The above table explains a ranking where call spreads are ordered in decreasing values of max payout/cost. We find that skews aren’t steep enough vs ATM to allow for a wide range of strikes to be efficient.

In order to ensure more than 50% discount to the outright vanilla, and a max payout/cost higher than 3.5:1, one needs to choose a combination of long 40D vs 25D. The call spread achieves a 55% discount to outright call and a max payout/cost ratio of 3.7:1 (mid values).

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One