Well, keeping important resistance (at 0.6723) in mind one can speculate this pair with binary one touch calls (beyond boundaries for 50-60 pips) but in the contrast advice for long-term investors is that don't get bull trapped in this pair as it is clearly dipping within a southward channel that has moved way below 21DMA on weekly as well. We are fairly positioned for bearish targets in 2016 and forecast for NZD/USD at 0.59 by Q1 of 2016 and 0.61 by Q4 of 2016.

In addition, the RBNZ will probably may ease twice more due to a slowing economy and below-target inflation.

Thereby, NZD should weaken again on rate compression from both sides as the Fed hikes and RBNZ eases another 50bp (only 25bp is priced). Fed hike may perhaps be deferred on hints of global slowdown. The newer theme is material deterioration in the current account deficit from -3.5% to -6% or -7% (just shy of the record -8%) on a low household saving rate and falling dairy prices.

Hedging Strategy: NZDUSD

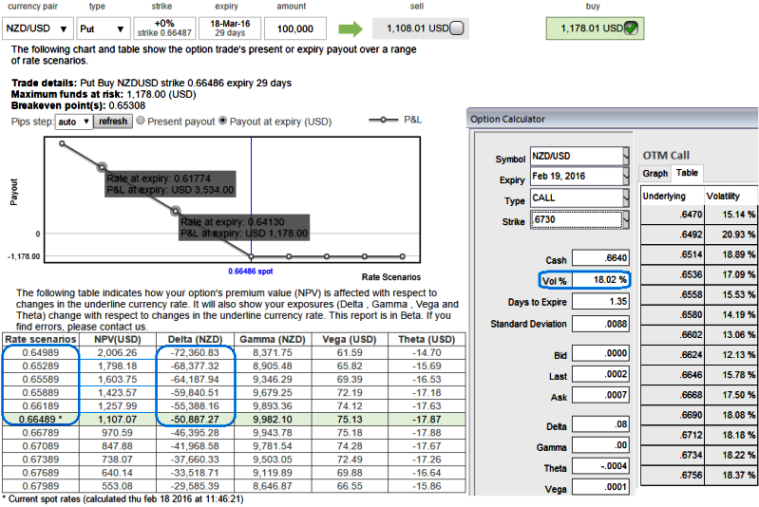

These options combinations are to be deployed anticipating short term interim upswings and more downside potential in long run, now have a look at the diagram from prevailing prices of ATM puts and they are moving in line with healthy delta.

Thus, on hedging grounds, the recommendation is to go long in 1M at the money -0.49 delta at the money put and simultaneously short 1W (1.25%) out of the money call with positive theta value and delta close to zero.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

The value of an option for every point's movement in the underlying is constantly changing. The delta can be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option's value will increase or diminish as the underlying market moves.

FxWirePro: Kiwi dollar's gains momentary, stay hedged via diagonal option combinations

Thursday, February 18, 2016 6:36 AM UTC

Editor's Picks

- Market Data

Most Popular