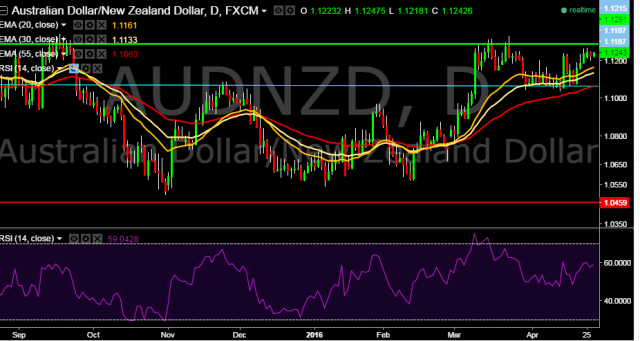

- AUD/NZD is trading around 1.1243 marks.

- Pair made intraday high at 1.1244 and low at 1.1218 marks.

- New Zealand’s monthly trade surplus contracted from a revised $367 million in February to $117 million last month, coming in much weaker than the median analyst forecast of a surplus worth $400 million.

- Intraday bias remains bullish till the time pair holds immediate support at 1.1188 marks.

- A sustained close above 1.1248 will drag the parity higher towards 1.1298/1.1317/1.1352/1.1590 levels.

- A daily close below 1.1209 will take the parity down towards 1.1146/1.1062/1.1016/ 1.0934 marks.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend.

- Australia will release CPI data at 0130 GMT. The market forecast of a 0.3% reading in the CPI over the March quarter vs 0.4% previous release.

We prefer to take long position in AUD/NZD around 1.12, stop loss 1.1146 and target 1.1298 marks.