- AUD/NZD is trading around 1.0478 marks.

- Pair made intraday high at 1.0531and low at 1.0456 marks.

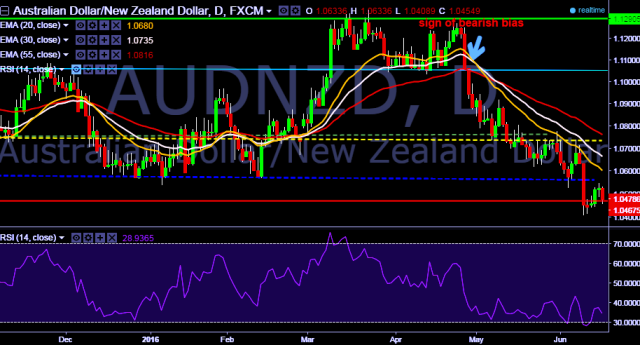

- Intraday bias remains bearish till the time pair holds initial resistance at 1.0547 marks.

- A sustained close above 1.0547 is required to drag the parity higher towards 1.0647/1.0748/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA)/1.1123/1.1298/1.1317 levels respectively.

- Alternatively, a daily close below 1.0496 will take the parity down towards key supports around 1.0408, 1.0362 and 1.0231 marks respectively.

- Today New Zealand released GDP data with positive numbers at 0.7% q/q vs 0.5% q/q growth rate forecast by markets.

- Important to note here that, 20D, 30D and 55D EMA heads down and confirms bearish trend in a daily chart.

We prefer to take short position in AUD/NZD around 1.0485, stop loss 1.0547 and target 1.0408 levels.