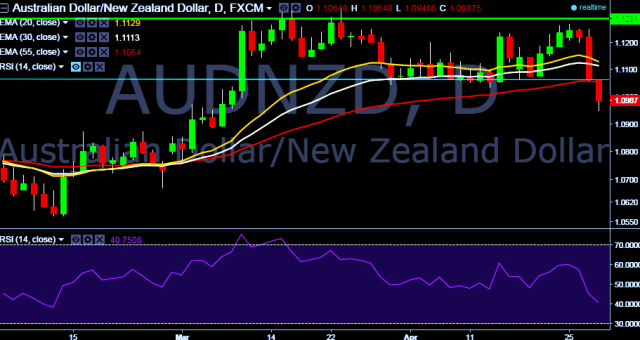

- AUD/NZD is trading around 1.0987 marks.

- Pair made intraday high at 1.1064 and low at 1.0948 marks.

- Today RBNZ left interest rates on hold after cutting the OCR to a record-low 2.25% just last month.

- Intraday bias remains bearish till the time pair holds immediate resistance at 1.1062 marks.

- A daily close below 1.1062 will take the parity down towards 1.0934 and 1.0890 marks respectively.

- On the other side, a sustained close above 1.1062 will drag the parity higher towards 1.1123/1.1298/1.1317/1.1352/1.1590 levels.

We prefer to take short position in AUD/NZD around 1.1025, stop loss 1.1062 and target 1.0890 marks.