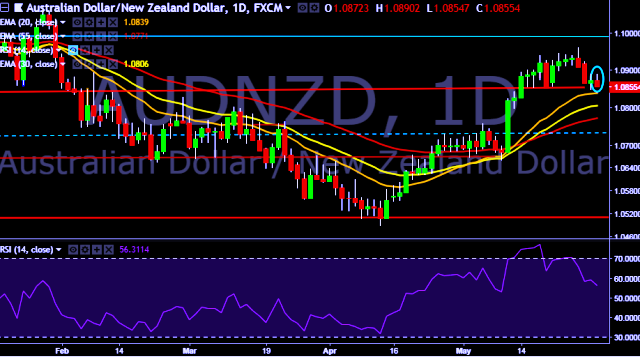

- AUD/NZD is currently trading around 1.0855 marks.

- Pair made intraday high at 1.0890 and low at 1.0850 marks.

- Intraday bias remains slightly bearish till the time pair holds key resistance at 1.0890 mark.

- A sustained close above 1.0872 will drag the parity higher towards key resistances at 1.0890/1.0927/1.0998/1.1072/1.1122 levels respectively.

- Alternatively, a daily close below 1.0872 will take the parity down towards key supports around 1.0845/1.0795/1.0736/1.0620/1.0572/1.0506 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart. Current downside movement is short term trend correction only.

- RBNZ says to leave LVR restrictions unchanged.

- RBNZ says household mortgage debt remains high.

- RBNZ says most dairy farms are currently cash-flow positive, but remain vulnerable to any possible downturn in dairy prices and agriculture shocks.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest