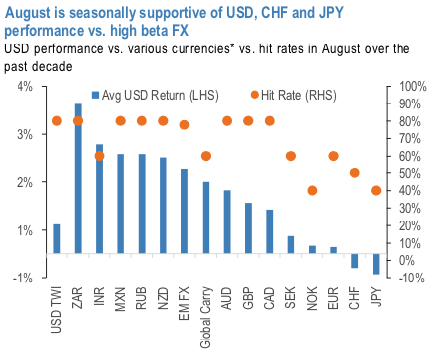

RBNZ has traditionally been somewhat more sensitive to global developments. A rate cut is already essentially fully priced for next week, and expectations increasingly seem to be for a dovish outcome. The combination of disappointing local business confidence data along with renewed global concerns could still manage to tilt the policy meeting dovishly as a result (we still view the terminal rate ultimately arriving at 1% given current growth and inflation undershoots). Positioning as of earlier this week has also lightened up recently which projects scope for further NZD downside (refer 2nd chart). And as described above, both AUD and NZD tend to be laggards in the month of August, and given the current risk and central bank environment, seem poised to deliver another month of antipodean underperformance (refer 1st chart).

For these reasons, we increase our high beta exposure by layering in a new NZDUSD short in cash to capitalize on both an underwhelming local story along with the defensive risk environment. Meanwhile, the uptick in vol and strong move in the spot has brought our NZDJPY back into the green and remains another core expression of a defensively-oriented portfolio. Ultimately, August looks like it could be a long month between now and the September 1 tariff deadline, which seems liable to keep NZD on the back foot.

NZDJPY’s two-month-old decline remains intact, with below 69 levels looks vulnerable in the near term. Global risk aversion over the past month has boosted the yen’s appeal.

In the medium-term perspective, we foresee further slumps at year-end. BoJ monetary policy is likely to remain accommodative for an extended period.

Trade tips:

Uphold a 6m NZDJPY put spread. Bear put spread (35d/15d strikes) (Spot reference: 69.613 levels). Paid 1.07% at the end of May. Marked at +1.13%.

Alternatively, we foresee NZDUSD major downtrend continuation up to 0.64 levels, shorting futures of mid-month tenors have been advocated ahead of RBNZ monetary policy with an objective of arresting further potential slumps, we wish to uphold the same positions. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook