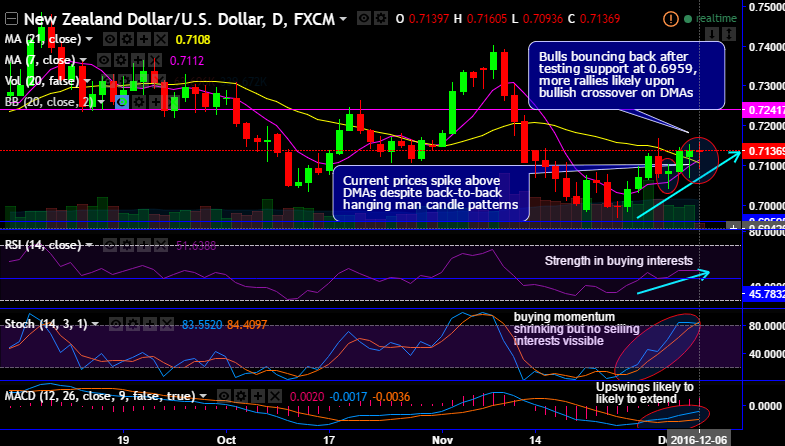

The pair has been consistently been bouncing back after testing support at 0.6959.

The current prices spike above DMAs despite back-to-back hanging man candle patterns at 0.7088, 0.7139 and now again today’s candle seems like the same pattern at 0.7134 levels.

For now, extended rallies seem most likely upon bullish crossover on DMAs (7DMA is attempting to crossover 21DMA), while MACD’s bullish crossover also signals the extension of upswings.

To substantiate this interim bullish sentiment, RSI’s positive convergence to the ongoing rallies signals the strength in buying interests, while stochastic indicates that the buying momentum is also shrinking but no selling interests visible on the contrary.

Remember, very recently the pair has collapsed to the lows of 4 and half months i.e. 0.6971, and rest in history but for now, manage to the current levels of 0.7003.

The US dollar may manage to bounce back at any time and break the important support in medium terms against Kiwi dollar ahead of Fed’s rate announcements in December meeting (hopes intensify after recent FOMC minutes).

Expect more slumps in long run upon slide below support 0.7080 & 21DMA after rejecting stiff resistance

21-SMA crosses over 7-SMA on weekly chart which is a bearish crossover that signals more weakness.

Additionally, you could probably make out that the huge volumes being established on declining trend on both weekly and monthly terms. While weekly MACD also evidences the bearish crossover to signal more slumps on the cards in the upcoming weeks.

Most importantly, please be noted that the volumes are massive on declining prices (see huge histogram to indicate huge volumes) while leading indicators on both timeframes are indicative of selling momentum.

Hence, we advise short term bullish opportunities in one touch binary calls, while one can still eye on fresh short build ups via mid-month futures contracts snapping every rally for targets of 0.7046, 6946 levels and even upto 0.6812 levels (i.e. 28.6% fibos) upon breach of the 1st target, maintain a strict stop loss of 0.7184 levels.