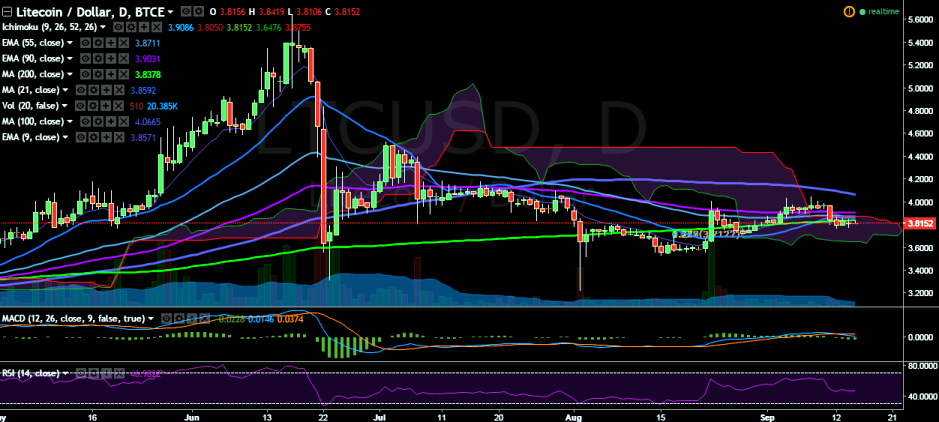

LTC/USD continues to hover around 200-day MA and struggling for a consistent break above this level from past couple of days. It is currently trading at 3.81 levels (BTC-e).

Short-term trend: Bearish

Ichimoku analysis of daily chart:

Tenkan Sen: 3.90

Kijun Sen: 3.80

Trend reversal: 3.90 (90 EMA)

“The pair managed to slightly break above 200-day MA on Wednesday, but facing strong resistance at 3.85 levels (21-day MA), it fell and closed at 3.81 levels. Short-term trend appears weak in the pair and a dip till 3.50 is possible”, FxWirePro said.

On the topside, a break above 3.85 (21 DMA) would target 3.90 (90 EMA)/ 4.05 (September 08 high). Bullishness in the pair could be confirmed only if it breaks above 4.05 levels.

The pair has found near 3.73 (38.2% retracement of 3.22 and 4.05), however, a close below 200 DMA on Wednesday suggests further downtrend. A break below 3.73 would target 3.50 (psychological level)/ 3.22 (August 02 low).

FxWirePro: LTC/USD struggles to close above 200-DMA, good to sell on rallies

Thursday, September 15, 2016 11:31 AM UTC

Editor's Picks

- Market Data

Most Popular